Bitcoin Mining Difficulty Hits a New Record, Estimated to Rise Further

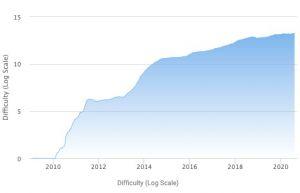

The difficulty of mining bitcoin (BTC) has just reached another all-time high, after rising more than expected during today’s difficulty adjustment. Meanwhile, the network’s hashrate is still below its all-time high from back in July.

As reported five days ago, bitcoin’s mining difficulty, which is the measure of how hard it is to compete for mining rewards, was expected to rise to a new all-time high today, per estimates from BTC.com – a rise of 3% would’ve brought bitcoin’s difficulty up to a level of 17.45 T predicted then.

Just ahead of the adjustment, however, the estimate has increased slightly, indicating a rise of 3.6% to a total of 17.56 T – higher than at any other point in bitcoin’s history.

What’s more, according to BTC.com, the next adjustment in about 14 days from now (every 2016 blocks, to be precise), if the estimates come true, would mark two new milestones for the bitcoin network, as it would make yet another all-time high, as well as for the first time reach into the 18 T zone.

Today’s jump in difficulty is in no way unusual, however, and is indeed smaller than many previous adjustments of the difficulty level. On June 16 this year, bitcoin’s difficulty jumped by nearly 15%, while July 13 saw an increase of almost 10%.

Meanwhile, the hashrate of the network, or the computing power dedicated to mining bitcoin, has continued to decline after reaching an all-time high of 139.5 E on July 25, to the current 125.8 E, using raw values.

Using the more smoothed out 7-day moving average, however, the hashrate is now back at levels not seen since late July, hovering around the 120 E level.

As reported earlier, the hashrate also saw a fall of about 25% in a matter of just days earlier this month. Back then, the fall was widely believed to be linked with the massive floods happening in Southwest China’s Sichuan province, a region known for its high number of bitcoin mining farms.

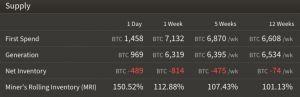

And while the hashrate falls, data from ByteTree shows that bitcoin miners are also offloading far more bitcoin than they mine. In the past week, miners on the whole spent BTC 7,132, while their mining operations generated just BTC 6,319, a difference of BTC 813, or about USD 9.6 million.

At 09:50 UTC Monday morning, bitcoin was up by 1.3% over the past 24 hours to trade at a price of USD 11.767 per coin. It’s down 1% in a week.