Bitcoin Climbs Above USD 44K, Analysts See a Bull Long-term Too

While bitcoin (BTC), ethereum (ETH), and most of the broader crypto market rose higher in price today, a number of researchers and analysts are arguing that the crypto market may be bottoming out and that it could be in for a bullish ride later in the year, prompted by a number of possible catalysts. Still, they urge caution.

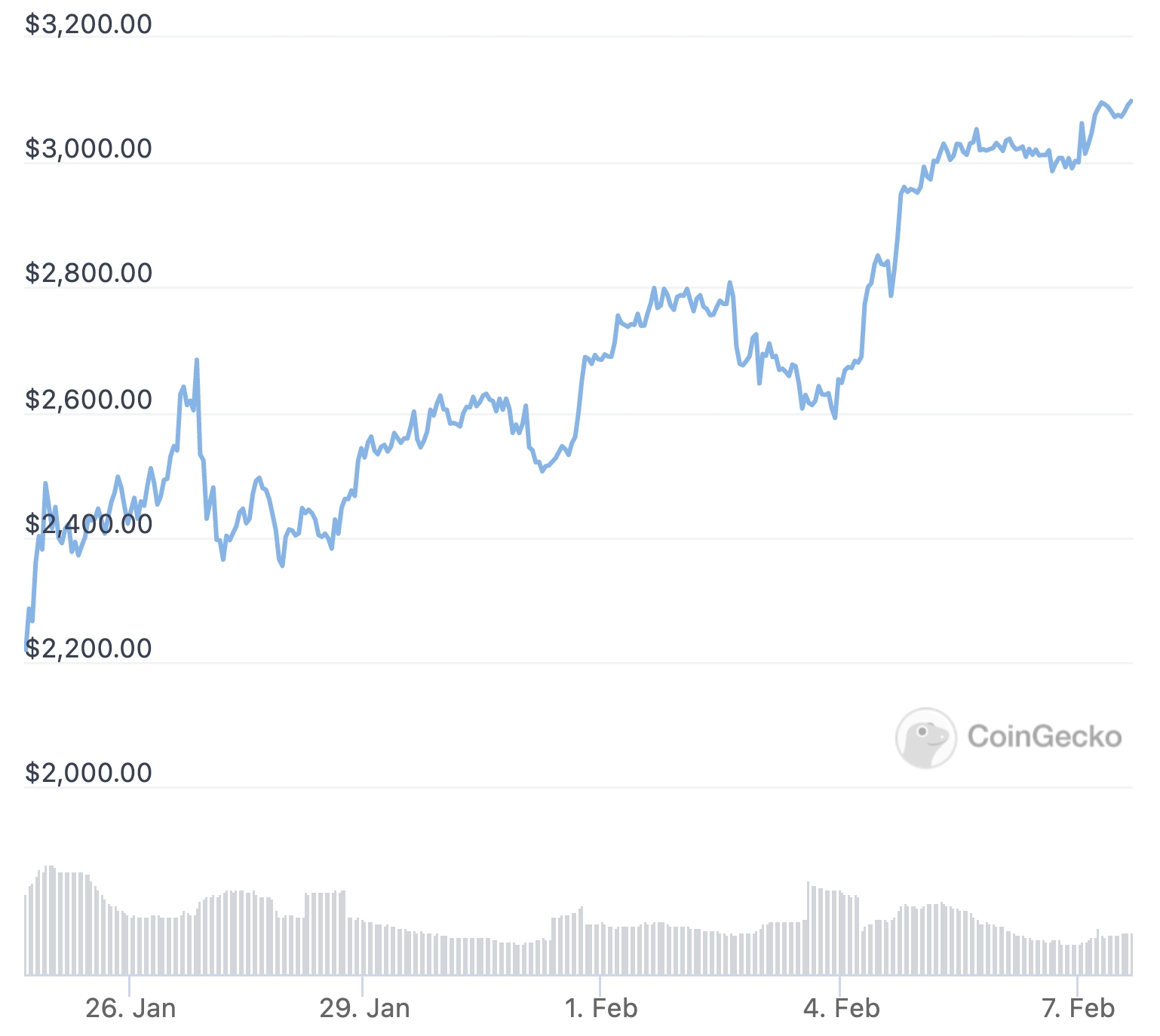

At 18:18 UTC, BTC trades at USD 44,310 and is up 6% in a day and 14% in a week. ETH trades at USD 3,161, increasing by 5% in a day and 19% in a week.

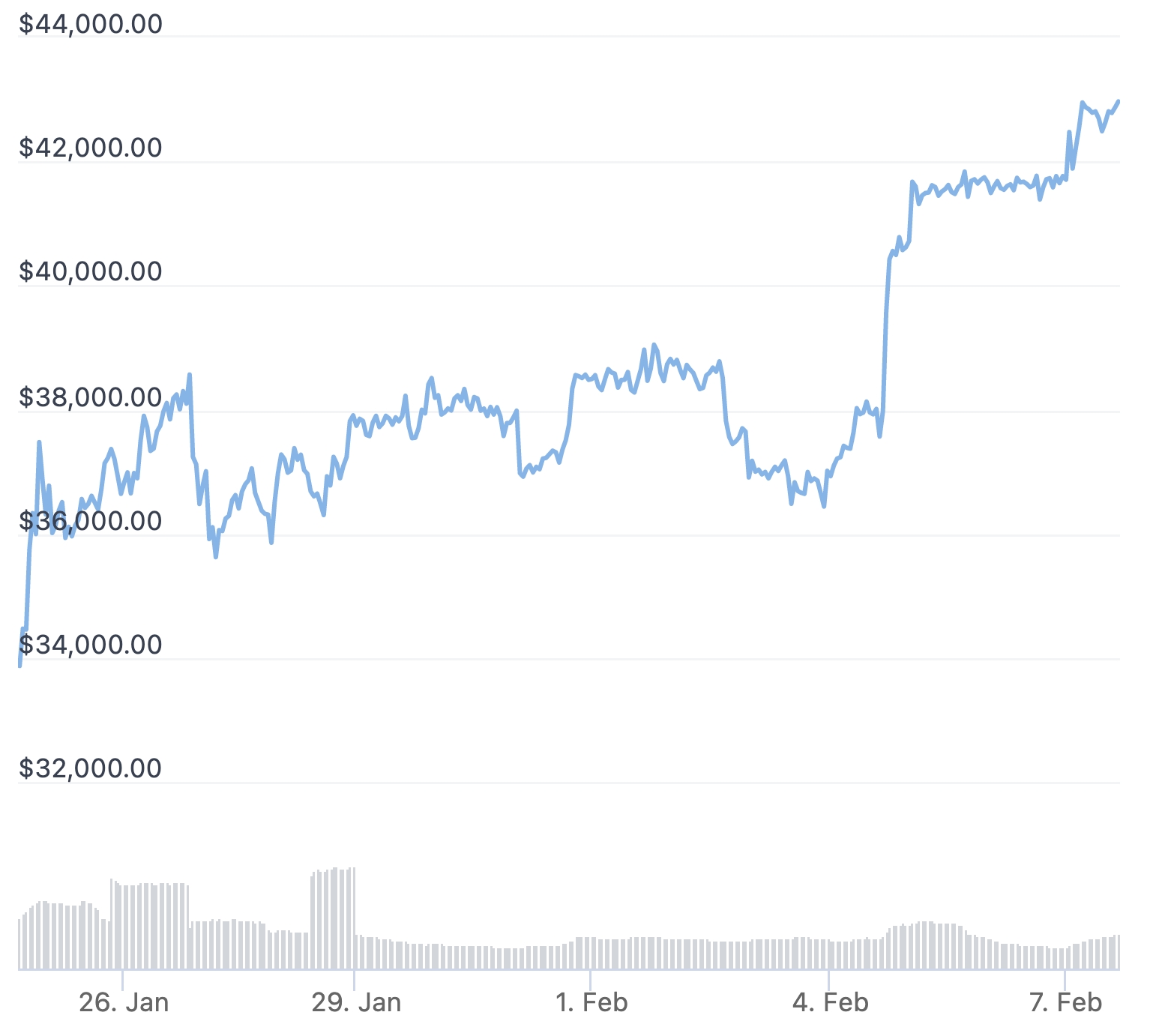

Bitcoin’s move higher on Monday brought the price of the coin above its 50-day moving average line, an important level in the chart often followed by technical analysts. The crossing marks the first time since November last year that bitcoin has traded above the key level, and could indicate that a more bullish chart structure is in the making.

“Bitcoin has broken some key levels and a downward-trending line here over the past few days and is showing signs of bullishness,” Vijay Ayyar, head of Asia-Pacific at crypto exchange Luno told Bloomberg in a comment today.

He added that BTC is “capped by the 50-DMA and needs to close above it,” and that a likely near-term target would be in the USD 46,000 to 47,000 area.

At the time of writing, data from crypto exchange Binance showed that bitcoin’s 50-day moving average stood at USD 42,795.

BTC saw strong bullish action on Friday when the coin shot up above USD 40,000 after trading below the psychologically important level for two weeks, while ETH broke above the key USD 3,000 mark the next day.

BTC price last 14 days:

Ethereum’s gains are recorded on a day when the native tokens of other smart contract protocols also jumped, with Solana’s SOL up 6%, Polkadot’s DOT also up 6%, and Avalanche’s AVAX up 10% over the past 24 hours.

ETH price last 14 days:

Commenting on Twitter, Arcane Assets Chief Investment Officer Eric Wall called USD 40,000 to 43,000 “the fomo [fear of missing out] range” for bitcoin, and said this is the area where people who sold in the USD 33-35,000 zone will “panic buy back in.”

$40-43k run completed in *checks notes* 2.5 days https://t.co/rZx3SCRlL0

— Eric Wall (@ercwl) February 7, 2022

Even more bullish was the financial research firm FSInsight, which in a report last week said that it expects “macro tailwinds” in the second half of the year, combined with an expected rise in bitcoin’s market-value-to-realized-value (MVRV), to bring BTC to USD 200,000 by the end of the year.

The report added that several other potential catalysts for bitcoin are also on the horizon this year. This includes a possible spot-based exchange-traded fund (ETF) being approved in the US, sovereign nations following in El Salvador’s footsteps and adopting BTC as legal tender, and the potential for broader adoption in emerging markets with volatile currencies such as Turkey, the firm said.

Lastly, the on-chain analysis firm Glassnode also speculated today that the bottom may be in for bitcoin, saying in its weekly report that the USD 30,000 to 40,000 area “has proven to be a sturdy support level.”

“[T]here is a reasonable degree of momentum behind this rally,” Glassnode’s report said, although it also warned that the market “remains top-heavy in supply distribution” with over 25% of all bitcoin now holding unrealized losses.

“Key to watch moving forward is whether Long-term holders and older coins take exit liquidity, and whether the rally can be supported by renewed demand which has been lacking in general since the May sell-off,” the report concluded.

The gains for BTC and ETH today came as the stock market saw a mixed performance, with US S&P 500 futures pointing lower during the European trading session before moving into positive territory ahead of the opening of the market on Wall Street.

According to Reuters, the slump in stocks on Friday and Monday morning followed strong job numbers and a higher-than-expected hourly earnings report from Friday making traders worried that the US Federal Reserve might turn more aggressive in its fight against high inflation.

Meanwhile, the moves in the crypto market today also followed a volatile previous week for many tech stocks.

Among the biggest losers was the Facebook owner Meta, which lost USD 200bn from its market value over the week on disappointing results. On the other hand, e-commerce giant Amazon added about the same amount to its market value after posting better-than-expected results.

____

Learn more:

– Bitcoin to Hit USD 93K This Year, According to Less Optimistic Survey

– USD 100K per Bitcoin ‘Hopium’ Now Moved to Mid-2022

– Bitcoin Is ‘Fundamentally Different’ From Other Cryptos, Unlikely To Be Replaced – Fidelity

– Analysts Say That Bitcoin and Ethereum May Be Bottoming Out (Soon)

– Fiat Fears Intensify as Turkey’s Inflation Runs Wild; Citizens Turn to Bitcoin, Tether

– Goldman Sachs Claims Adoption Won’t Boost Crypto Prices, Talks Down Stablecoin Plans

___

(Updated at 18:20 UTC with the latest market data.)