Bitcoin and S&P 500 Correlation Grows, Miners Accumulate BTC Again (UPDATED)

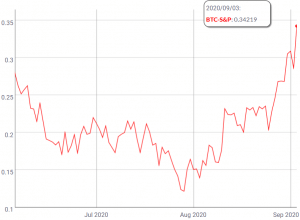

As the US stock market renewed its sell-off today, the crypto market erased gains made earlier this Friday, dropping for the third day in a row while Bitcoin (BTC) miners sold less BTC. (Updated at 15:33 UTC: updates throughout the entire text.)

US stock market indices DOW 30, S&P 500 dropped by around 2%, while NASDAQ decreased by 4% (15:14 UTC). US employers added 1.4m jobs in August, sending the unemployment rate down to 8.4%, or more than estimated, according to The Financial Times. However, the biggest US tech shares extended their tumble as traders looked past a better-than-forecast jobs report to focus on concerns about excessive valuations for some of this year’s best performers, Bloomberg reported.

The crypto market once again followed stocks, sending the total market capitalization to USD 333.9bn, down from USD 346bn, reached earlier today.

BTC and S&P correlation chart:

At pixel time (15:20 UTC), BTC trades at USD 10,284, dropping from the USD 10,500 level reached earlier today. The price is down by 4% in a day and 10.5% in a week. Ethereum (ETH) also erased its gains, trading at USD 376 after it briefly touched USD 400 earlier today. ETH is down by 7% in day and 5% in a week.

According to blockchain analytics firm IntoTheBlock, in order for BTC to reach USD 11,000 again, it has to go through 1.2 million addresses that previously bought 864,000 BTC.

“If bitcoin breaks the USD 11,000 barrier, the most crucial resistance level sits at that USD 11,500. Roughly 1.82 million addresses previously purchased approximately 1 million BTC at the range between USD 11,354.75 and USD 11,663.72,” they said, adding that BTC “sits on a massive supply barrier around USD 9621,01 that may absorb the downward pressure.”

Over 1.2 million addresses had previously purchased a total of 783,000 BTC between USD 19,482 and USD 9,791, their data shows.

Meanwhile, almost all top 100 coins are in the red today. Even tron (TRX) (-12%), EOS (0%) erased their gains on Friday. Meanwhile, Celo (CELO) is still up by 19%. It rallied after it was recently listed on a number of exchanges, including Coinbase Pro, Gate.io, and OKEx.

On the whole, however, the market is still in a sea of red after the sharp correction, with the worst-hit part of the market over the past 24 hours being DeFi tokens like REN (down 22%), SUSHI (down 24%), BAL (down 22%), while yearn.finance (YFI) dropped by 21%.

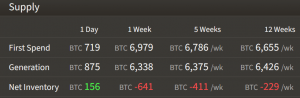

Also, while yesterday we saw miners moving unusually large amounts of bitcoin to exchanges, signs today suggest that the selling has slowed down, with miners once again accumulating BTC on a 1-day basis. According to data from ByteTree, bitcoin miners on the whole increased their inventory by 156 BTC over the past 24 hours, after cutting their daily selling of coins by around half since yesterday.

James Bennet, CEO at ByteTree, previously told Cryptonews.com that miners typically build their inventory during market weakness and sell into strength. As the price recovers, miners might start offloading their inventory again. “Miners want to get the best price for their bitcoins but still need to cover operational expenses. They are generally not long-bitcoin, but are market savvy,” according to Bennet.

Meanwhile, sell liquidation figures from Skew showed that the party ended badly for many (over)leveraged bitcoin traders on the crypto derivatives exchange BitMEX, with total hourly liquidations reaching USD 94 million at noon yesterday (UTC).