Best 10 Defi & Defi 2.0 Tokens and Projects in 2022

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

If you watch the financial markets, you might have heard the words “decentralized finance,” or “DeFi,” pop up frequently.

The thriving peer-to-peer crypto network is becoming a standard part of a diverse crypto portfolio, grabbing the attention of consumers and billionaire investors alike. But what is it exactly? And what makes DeFi different from every other sector of crypto that you know?

What is DeFi?

In a financial world that is becoming increasingly digital, DeFi focuses on bringing the convenience of peer-to-peer transactions to investors. By harnessing the efficiency and power of smart contracts — digital contracts that live on the blockchain — DeFi platforms create a space for lending, borrowing, trading, saving, and earning interest that doesn’t require all of the usual bureaucracy and minutiae.

The goals of the DeFi network are simple:

Ditch the paperwork

No paperwork and no wait time through the bank for transactions to clear.

Cut out the middleman

Automating the contract process on the blockchain eliminates the need for human intervention.

Pick up the pace

Doing business with DeFi is seamless and fast.

Equalize the opportunity

DeFi is closing the gap between the individual and the financial oligarchy.

At the beginning of 2019, the TVL of lending platforms (mainly MakerDAO) was USD 270 million. This momentum continued in 2020 as well, to the point where Compound launched its governance token, COMP which kicked off the craze and initiated the first call for liquidity mining.

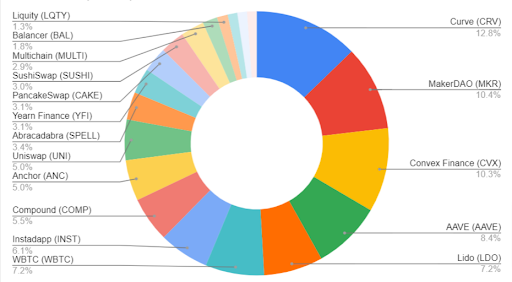

By Dec 2021, the TVL of DeFi jumped more than1000x, reaching USD 322.41 billion. You can see the Top 20 coins and projects below.

The Top 10 DeFi Picks for 2022

Select the most potential Defi token in 2022 from two aspects

- Arrange from the total locked position TVL

- Market value generated from market transactions (2021/12/28)

Both rankings for comprehensive evaluation and screening

| Name | TVL(Billion) | |

| 1 | Curve (CRV) | 23.32 |

| 2 | MakerDAO (MKR) | 19.01 |

| 3 | Convex Finance (CVX) | 18.83 |

| 4 | AAVE (AAVE) | 15.38 |

| 5 | Lido (LDO) | 13.23 |

| 6 | WBTC (WBTC) | 13.11 |

| 7 | Instadapp (INST) | 11.18 |

| 8 | Compound (COMP) | 10.14 |

| 9 | Anchor (ANC) | 9.14 |

| 10 | Uniswap (UNI) | 9.09 |

| 11 | Abracadabra (SPELL) | 6.18 |

| 12 | Yearn Finance (YFI) | 5.66 |

| 13 | PancakeSwap (CAKE) | 5.65 |

| 14 | SushiSwap (SUSHI) | 5.46 |

| 15 | Multichain (MULTI) | 5.23 |

| 16 | Balancer (BAL) | 3.29 |

| 17 | Liquity (LQTY) | 2.42 |

| 18 | Trader Joe (JOE) | 2.17 |

| 19 | CREAM Finance (CREAM) | 2.16 |

| 20 | Terraswap | 2.16 |

| SUM(USD) | 182.81 |

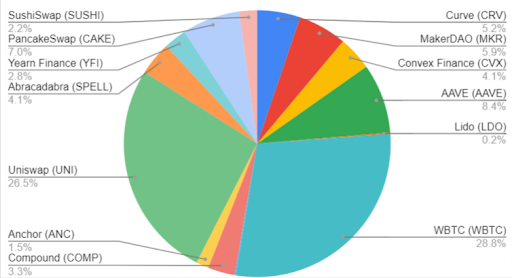

The Market Value of Defi

| Name | Market Value | |

| 1 | Curve (CRV) | 2,391,723,084 |

| 2 | MakerDAO (MKR) | 2,699,252,811 |

| 3 | Convex Finance (CVX) | 1,884,814,712 |

| 4 | AAVE (AAVE) | 3,861,397,967 |

| 5 | Lido (LDO) | 68,816,906 |

| 6 | WBTC (WBTC) | 13,181,079,852 |

| 7 | Instadapp (INST) | 63,307,203 |

| 8 | Compound (COMP) | 1,494,238,502 |

| 9 | Anchor (ANC) | 699,526,241 |

| 10 | Uniswap (UNI) | 12,134,565,172 |

| 11 | Abracadabra (SPELL) | 1,861,119,927 |

| 12 | Yearn Finance (YFI) | 1,262,026,858 |

| 13 | PancakeSwap (CAKE) | 3,207,022,824 |

| 14 | SushiSwap (SUSHI) | 1,005,994,188 |

1.Curve (CRV)

Curve is a decentralized stablecoin exchange whose liquidity is managed by an automated market maker.

Curve Finance’s governance token is CRV. This protocol implemented a complex time-based staking system to exchange CRV into veCRV, where veCRV is a token for governance purposes and has the right to claim the cash flows generated by the protocol.

2.MakerDAO (MKR)

With Maker, users can lock-in collateral as collateral for loans in exchange for Dai. The Maker Foundation founded it in 2015 as an open-source project to offer economic freedom and opportunity to anyone, anywhere. Towards the end of 2017, Maker launched its first stablecoin, the Single Collateral Dai (SAI), which used Ether (ETH) as collateral.

3.AAVE (AAVE)

With AAVE, an Ethereum token, users can participate in a non-custodial decentralized money market. In exchange for paying a variable interest rate, deposits provide liquidity to the market, while borrowers can borrow cryptocurrencies.

4.WBTC (WBTC)

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin (BTC), which runs on the Ethereum blockchain (ETH).

WBTC is compatible with ERC-20 – the basic compatibility standard of the Ethereum blockchain – enabling it to be fully integrated with the latter’s ecosystem of decentralized exchanges, crypto lending services, prediction markets, and other DEFI-enabled decentralized applications.

5.Convex Finance (CVX)-Defi 2.0

Convex simplifies the Curve boosting experience to maximize yields. With Convex, Curve liquidity providers can earn trading fees and claim boosted CRV without locking CRV themselves. Offering liquidity rewards and boosted CRV is easy for liquidity providers.

Convex allows users to stake CRV as well as receive trading fees and a portion of boosted CRV received by liquidity providers. It improves the balance between liquidity providers and CRV stakeholders as well as capital efficiency.

6.Uniswap (UNI)

UniSwap is a decentralized exchange (DEX) that lets users swap ERC-20 tokens without an intermediary. Trading tokens on a DEX avoids the risk of centralized exchanges and storing tokens on any exchange.

A market maker (AMM) provides liquidity to traders via token deposits into the Smart Contract via Liquidity Providers (LP). The protocol compensates liquidity providers with a 0.3% trading fee.

7.Compound (COMP)

Users of Compound can lend or borrow selected cryptocurrencies on a decentralized blockchain. As a result, it sets interest rates based on supply and demand of assets by pooling assets.

The users of Compound will be able to deposit their crypto assets to Compound and they will be aggregated into a liquidity pool. After users deposit, they will receive cTokens in return. By holding the cTokens, users can earn interest.

8. PancakeSwap (CAKE)

Powered by Binance Smart Chain (BSC), PancakeSwap is a decentralized exchange. This is the largest AMM-based exchange on BSC. Binance Smart Chain has much lower transaction fees than Ethereum. CAKE is the governance token for PancakeSwap.

9. Lido (LDO)-Defi 2.0

The Lido staking solution works with Ethereum (ETH). Using Lido’s staking solution, users can stake ETH while circumventing asset locking requirements. In preparation for ETH 2.0, users’ ETH funds are currently locked and will remain so until the new mainnet is launched. As ETH2.0 is seeing regular release date pushbacks, this transaction release could take years. With standard ETH2.0 staking, users can only stake in multiples of 32 (ETH). In light of current prices, $150,000 USD is the minimum stake amount. Lido eliminates this barrier.

10.Abracadabra (SPELL)-Defi 2.0

Abracadabra Money utilizes interest-bearing tokens (ibTKNs) like yvWETH, yvUSDC, yvYFI, yvUSDT, etc. as collateral to borrow MIM (Magic Internet Money) that is USD-pegged. MIM works like any other stablecoin.

Tokens bearing interest have been introduced by Abracadabra Money. Previously, they sat idle. Abracadabra Money lets users leverage their funds at minimal risk to reach the next threshold, opening up a variety of additional models and possibilities.

There are two main tokens in the Abracadabra Money ecosystem:

SPELL serves as the governance token.

MIM is the core component to sustain Abracadabra Money’s lending model.