How to Buy Bitcoin in Canada in 2024

Bitcoin is the world’s largest cryptocurrency by market cap and has been called digital gold by some analysts. It’s used around the world as a store of value, a means of payment for goods and services, and an asset for trading and investing.

Many Canadians already know what Bitcoin is, but they may not be as familiar with how to buy it. In this guide, we’ll explain how to buy Bitcoin in Canada from a crypto exchange and highlight the best exchanges. We’ll also take a look at alternative ways to buy Bitcoin and some tips to consider.

Buy Bitcoin in Canada through a Crypto Exchange

The easiest and most affordable way to buy Bitcoin in Canada is to use a crypto exchange.

A crypto exchange is a platform that lets you buy and sell cryptocurrencies. They operate somewhat like brokerages, but for crypto instead of stocks. Importantly, exchanges accept dollars, so they serve as an on-ramp into the world of crypto for people who don’t already own Bitcoin.

Crypto exchanges are designed to be beginner-friendly. At most Canadian Bitcoin exchanges, users can buy Bitcoin instantly with a credit card, debit card, or bank transfer. Exchanges also have built-in crypto wallets, allowing you to store your Bitcoin with the exchange just like you would hold stock shares at a broker.

Crypto exchanges aren’t free, but they have very low fees compared to other methods for buying Bitcoins in Canada. Most exchanges charge 1.5-4.5% for instant Bitcoin purchases using a credit card. Advanced users who are comfortable using an exchange’s trading platform can get fees starting around 0.1% per purchase.

Step-by-Step Process of Buying Bitcoin in Canada

Let’s walk through a step-by-step tutorial on how to buy Bitcoin in Canada from a crypto exchange.

Step 1: Choose a Crypto Trading Service or Exchange

The first step to buy Bitcoin in Canada is to decide what crypto exchange you want to use. We’ll highlight several of the best Canadian exchanges in the next section.

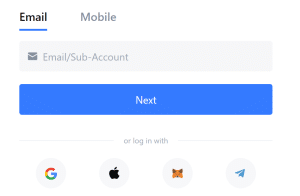

Once you pick an exchange, sign up and create an account. You’ll need to provide your name, email, phone number, and address. You’ll also need to upload a copy of your driver’s license or passport in order to comply with anti-money laundering requirements.

Step 2: Connect Your Exchange to a Payment Option

Once your account is set up, you can make a deposit. Most Canadian exchanges accept a wide range of payment methods including credit and debit cards, bank transfers, and e-wallets.

Step 3: Place an Order

There are two ways to place an order on most exchanges.

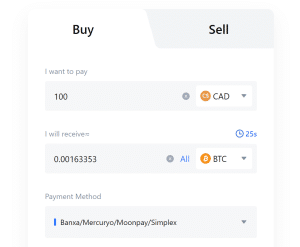

The simplest way is to use the instant buy option, which is usually labeled as ‘Buy Crypto’ or similar. Here, all you have to do is enter the amount of Bitcoin you want to buy and click purchase. This usually incurs a fee of around 1.5-4.5%.

An alternative, cheaper way to buy Bitcoin is to open the exchange’s trading platform and search for the BTC/CAD trading pair. This usually involves a transaction fee of around 0.1%.

Set up a market order (which will buy Bitcoin at the current market price) and enter the amount of Bitcoin to buy. Don’t set a take-profit or stop-loss level with your order. When ready, click ‘Buy’ to purchase Bitcoin.

Step 4: Safe Storage

By default, Bitcoin you purchase on an exchange will be stored in a crypto wallet owned by the exchange. Many users prefer to leave their Bitcoin on their exchange account this way so that it’s easy to sell in the future. Just make sure that your exchange account has a strong password and two-factor authentication enabled.

Importantly, there have been instances of exchanges going out of business and taking customers’ Bitcoin with them in the past. So, some users prefer to hold their Bitcoin in their own crypto wallet.

If you choose to set up your own wallet and transfer your Bitcoin, it’s absolutely essential that you write down your wallet’s recovery key. This is the only way to access your Bitcoin if you ever lose your password.

Where to Buy Bitcoin in Canada

Now that you know the basics of how to buy Bitcoin in Canada, let’s take a closer look at some of the best crypto exchanges to use.

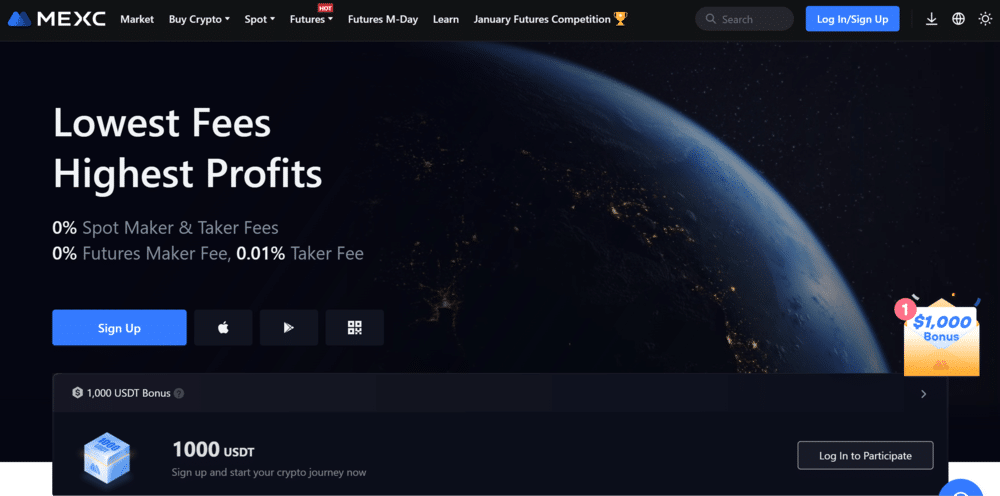

1. MEXC – Overall Best Crypto Exchange in Canada for 2024

MEXC is one of the best crypto exchanges in Canada to buy Bitcoin. It’s beginner-friendly, offers very competitive fees, and boasts excellent security for users who store their Bitcoin with the exchange.

MEXC accepts credit and debit cards as well as bank transfers for payment. Users can buy Bitcoin instantly for a fee of around 1% or use the spot trading platform and pay a fee of just 0.1%.

This exchange also stands out for its Bitcoin savings program, which offers 1.80% APY on BTC that users hold in their accounts. Bitcoin can be withdrawn from the savings program at any time.

MEXC offers detailed guides for first-time crypto buyers, including a crypto encyclopedia and market updates about the upcoming Bitcoin halving.

Buyers have the option to store their Bitcoin with MEXC, which secures your account with two-factor authentication and 24/7 monitoring. There’s a fee of around $10 to withdraw BTC to an external wallet.

| Fee to Buy BTC with Credit Car | Fee for BTC Spot Trading |

| 1% | 0.1% |

Pros

- Beginner-friendly exchange with fast registration

- Outstanding security for Bitcoin held with the exchange

- Low transaction fees for instant BTC purchases

- Buy Bitcoin with a credit card or bank transfer

- Earn up to 1.80% APY on your Bitcoin

Cons

- $10 fee to withdraw Bitcoin to an external wallet

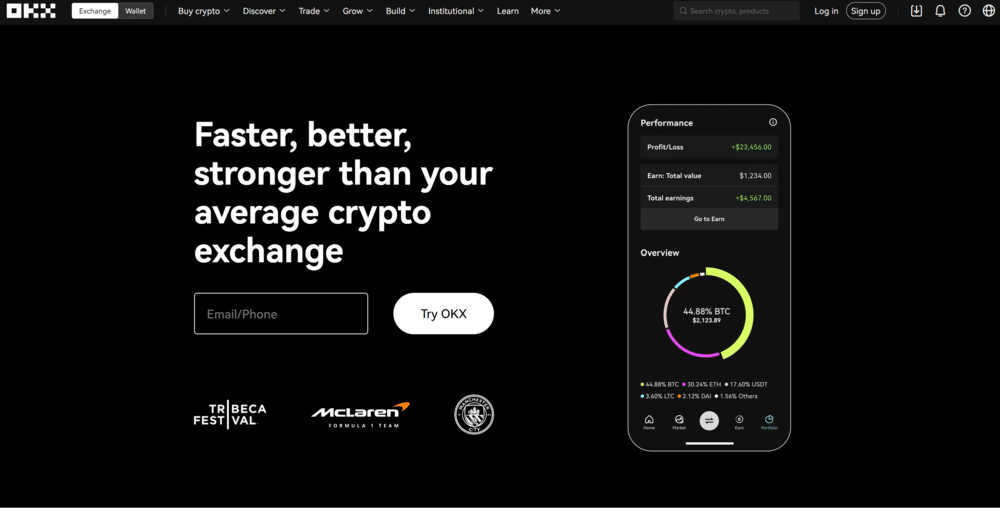

2. OKX – Best Mobile Crypto Exchange in Canada

OKX is another great choice to buy Bitcoins in Canada. It’s the world’s second-largest exchange by trading volume and offers a wide range of altcoins for users who want to buy more than just Bitcoin.

At OKX, users can deposit CAD with a credit card, debit card, or bank transfer. The fee to buy Bitcoin on the trading platform is 0.1%. OKX doesn’t specify the fee to instant buy Bitcoin with a credit card.

OKX offers a savings program for Bitcoin that lets users earn up to 5% APY with no lock-ups. That means users can withdraw or sell their Bitcoin at any time. The platform even lets users borrow crypto using their Bitcoin as collateral.

One of the best things about OKX is its mobile app, which makes it very easy to buy Bitcoin on the go. Users can set up price alerts, activate recurring purchases, or enter spot trades right from the app.

| Fee to Buy BTC with Credit Car | Fee for BTC Spot Trading |

| Not specified | 0.1% |

Pros

- Buy Bitcoin and 350+ altcoins

- Low spot trading fee for Bitcoin

- Accepts bank transfers and credit card payments in CAD

- Earn up to 5% APY on BTC

Cons

- Fees for instant purchases are not transparent

3. Binance – Best Crypto Exchange for Low Fees

Binance stands out as the exchange to use for Canadians in search of the lowest fees. The exchange recently waived all fees on Bitcoin trading pairs, including the BTC/CAD pair.

That means Binance users will pay nothing to buy Bitcoin on the exchange’s spot trading platform. There’s still a fee of 3.5% for users who instant buy Bitcoin using a credit card without first depositing funds to their account.

Binance has its own highly secure wallet and has never suffered a major loss of customer funds. So, users can feel confident about storing their Bitcoin with the exchange.

A savings program enables users to earn up to 0.29% APY on their Bitcoin, which is lower than other exchanges. However, Binance also has a ‘dual investment’ program that offers up to 188% APY. Note that this is more like trading Bitcoin options than putting BTC in a traditional savings program, and it can result in losing money.

| Fee to Buy BTC with Credit Car | Fee for BTC Spot Trading |

| 3.5% | None |

Pros

- No trading fees for spot Bitcoin pairs

- Excellent security record

- Dual investment program offers up to 188% APY on Bitcoin

- Tons of learning resources for new crypto users

Cons

- Many complex Bitcoin investment products to choose from

Other Alternatives to Buying Bitcoin in Canada

While using a crypto exchange is often the best path for beginners to buy Bitcoin in Canada, it’s not the only option. Let’s take a look at some alternative ways to buy BTC.

How to Buy BTC at a Traditional Stockbroker

A growing number of Canadian stockbrokers now offer users the ability to buy and sell Bitcoin. Brokers offering Bitcoin include Interactive Brokers, Eightcap, Wealthsimple, and more.

This approach is only suitable if you want to invest in Bitcoin in Canada or trade Bitcoin. That’s because there’s no way to move your Bitcoin out of a brokerage account and into a wallet to use it for purchases, DeFi, or other crypto services.

The advantage of buying Bitcoin from a stockbroker is that you can manage a BTC investment alongside other stock, forex, and commodity investments. In addition, some Canadian brokers offer low or no trade commissions for Bitcoin purchases.

Buy Bitcoin at an ATM

Buying Bitcoin at a Bitcoin ATM is relatively expensive, so it’s not recommended over using an exchange in most cases. Bitcoin ATMs can charge fees of more than 10%, more than 10 times what you’ll pay to buy Bitcoin at an exchange.

However, a Bitcoin ATM can still be a good option if you have physical cash that you want to convert to Bitcoin.

You can find Bitcoin ATMs across Canada from companies like FastBTC, Hodl Digital Services, and Bitcoin Depot. Most Bitcoin ATMs are located in major cities like Toronto, Vancouver, and Montreal.

How to Buy Bitcoin with a Credit Card

You can buy Bitcoin with a credit card at most crypto exchanges or Bitcoin ATMs. At a crypto exchange, simply choose the instant buy feature and select Visa or Mastercard as the payment option. You can buy Bitcoin in seconds following the steps we outlined above.

Note that exchanges usually pass on credit card transaction fees to customers. So, expect to pay a total fee of around 3.5% when buying Bitcoin with a credit card.

How to Buy Bitcoin through Trust or Exchange-Traded Fund (ETFs)

Canadian stock exchanges host numerous Bitcoin trusts and Bitcoin ETFs. These funds directly invest in Bitcoin and closely track its price. In effect, they offer a way for investors to buy Bitcoin just like they buy stocks. Investors don’t have to manage their crypto tokens at all.

The largest Bitcoin ETF in Canada is the Purpose Bitcoin ETF (BTCC), with $1.9 billion in assets under management. Investors can buy shares of this ETF—and thus buy Bitcoin indirectly—from any major Canadian stockbroker.

Note that buying Bitcoin through an ETF only offers a way to invest in Bitcoin in Canada. ETF investors cannot take their Bitcoin out of the ETF or take direct ownership of their tokens.

Buying BTC on Peer-to-Peer (P2P) Trading Platforms

P2P trading platforms enable individual crypto investors to buy and sell Bitcoin from one another. Sellers can specify how much Bitcoin they want to sell, at what price, and what payment method they are willing to accept. Buyers can potentially negotiate a lower price or get a discount on the current price of Bitcoin if they buy a large quantity of tokens.

Many major crypto exchanges in Canada, including MEXC, OKX, and Binance, offer P2P trading with no transaction fees. The exchanges host the P2P marketplace, but aren’t involved as intermediaries in these transactions.

How to Buy Bitcoin Through a Crypto Wallet

If you have a crypto wallet, it likely has a built-in decentralized exchange. This enables you to swap one cryptocurrency for another, usually for a very low transaction fee.

However, you cannot buy Bitcoin with dollars using a crypto wallet or decentralized exchange. These platforms are designed for users who already have crypto and don’t provide on-ramps to help you acquire crypto.

Where to Store Your Bitcoin

If you buy Bitcoin at a crypto exchange, you have two options for storing it: you can leave it in your exchange account or transfer it into your own crypto wallet. Let’s take a look at the pros and cons of each approach.

Storing Bitcoin on an Exchange

Storing Bitcoin on an exchange, inside your exchange account, is simple. You don’t have to transfer the BTC you buy or pay withdrawal fees. If you want to sell or convert your Bitcoin, it’s ready to go in your exchange account.

Exchanges use comprehensive security measures to protect users’ crypto. Many exchanges store 90% or more of the cryptocurrency they hold in cold wallets, which aren’t connected to the internet. This puts them out of reach even if an exchange is hacked.

On top of that, many exchanges have insurance policies to restore users’ funds in the event of a security breach.

The downside to storing Bitcoin with an exchange is that the exchange technically owns your crypto, not you. If the exchange were to go bankrupt, there’s no guarantee that you would get your crypto out. When the FTX crypto exchange went bankrupt, it was initially estimated that customers lost around $16 billion in crypto on the exchange.

Storing Bitcoin in Your Own Crypto Wallet

Storing Bitcoin in your own crypto wallet is the only way to ensure that you have complete control over your coins. However, it takes some work to keep your wallet secure and protect your Bitcoin against thieves.

One of the best things you can do is to set up a cold wallet, which isn’t connected to the internet. This could simply be a hard drive or a dedicated physical wallet device like those made by Ledger.

You should only use hot wallets—which are connected to the internet and include most software wallets, like MetaMask—when you’re actively transferring your Bitcoin to and from an exchange or using it to pay for services.

It’s extremely important to write down your wallet’s recovery key and store it somewhere safe. If you lose this key, you won’t be able to recover your Bitcoin if you lose the password to your wallet or lose your wallet device.

Key Considerations Before Buying Bitcoin in Canada and Other Regions

Before you buy Bitcoin in Canada, there are a few important things to keep in mind.

The Importance of Security

Security is extremely important whenever you’re dealing with cryptocurrencies. There are many instances of Bitcoin holders losing their coins to hacks and scams. In addition, exchange bankruptcies have resulted in billions of dollars worth of lost crypto for customers.

If you keep your Bitcoin in your own wallet, it’s crucial to ensure your wallet is secure. Only use a reliable wallet provider and set a strong password. Write down your wallet’s recovery key and put it somewhere safe. Check twice before connecting your wallet to any services or giving out your wallet address to ensure you aren’t being scammed.

Understanding Identity Verification Requirements

Governments around the world are increasingly cracking down on crypto exchanges and crypto service providers to do more to prevent money laundering. As a result, exchanges have implemented strict requirements for customers to verify their identity before they can buy or sell cryptocurrency.

For users, this means that you must present a copy of your driver’s license or passport in order to buy Bitcoin in Canada. This is required even if you use a Bitcoin ATM and pay with cash.

Assessing Fees Associated with Bitcoin Purchases

It’s also important to understand the fees associated with buying Bitcoin, which can vary widely depending on what approach you take and what service you use.

In general, you’ll pay the lowest fees for buying Bitcoin through an exchange’s spot trading platform or through a traditional stockbroker. Most exchanges charge spot trading fees starting at around 0.1% per transaction.

Bitcoin ETFs have annual management fees of around 1% rather than a one-time transaction fee.

Fees for buying Bitcoin instantly with a credit card at a crypto exchange are typically around 3.5% but can range from 1.5%-4.5%.

Bitcoin ATMs charge the highest fees. Expect to pay between 10%-20% of your total Bitcoin purchase as fees.

How to Buy Bitcoin in Canada Bottom Line

The best way to buy Bitcoin in Canada is by using a crypto exchange like MEXC, OKX, or Binance. These exchanges offer the lowest transaction fees and give you the option to store your Bitcoin on the exchange or in your own crypto wallet.

Other ways to buy Bitcoins in Canada include using a traditional stockbroker, buying Bitcoin ETFs, or using a Bitcoin ATM. However, these approaches may involve higher fees or will not allow you to use your Bitcoin for anything other than investing.

FAQs

How to invest in Bitcoin in Canada?

You can invest in Bitcoin in Canada by buying BTC from a crypto exchange and holding it. Alternatively, you can buy Bitcoin from a traditional stockbroker or buy shares of a Bitcoin ETF, like BTCC, through your stockbroker.

Is it legal to buy Bitcoin in Canada?

Yes, Bitcoin and other cryptocurrencies are legal in Canada. You can buy Bitcoin through licensed crypto exchanges, stockbrokers, or Bitcoin ATMs.

Is Bitcoin taxed in Canada?

Yes, Bitcoin is taxed in Canada similar to other investment assets. If you earn a capital gain by buying and selling Bitcoin, 50% of the profits are taxable. If you earn Bitcoin as income, it is taxed as income just like cash.

References

- https://www.statista.com/statistics/1208621/bitcoin-atms-city-canada/

- https://www.coindesk.com/coindesk-indices/2023/08/16/in-canada-spot-bitcoin-etfs-have-been-working-for-years/

- https://www.purposeinvest.com/funds/purpose-bitcoin-etf

- https://www.reuters.com/technology/ftx-customers-are-still-grappling-with-crypto-platforms-collapse-2023-10-05

Viraj Randev

Viraj Randev

Nick Pappas

Nick Pappas

Eric Huffman

Eric Huffman