10 Best Bitcoin Mining Rigs in April 2024

Following the launch of several Bitcoin ETFs, demand for Bitcoin mining is expected to increase. The right choices in Bitcoin mining hardware could make the difference between profitable mining or waiting for new all-time highs to make a profit. In this guide, we review the best Bitcoin mining rigs, whether mining with a single machine or building a farm.

The best Bitcoin mining machines center on a handful of hardware makers, providing a selection at several price points. We considered several factors, with one pass-or-fail criterion: The rigs had to turn a daily profit based on average electricity rates. Cost, terahashes per second (TH/s), and energy usage also play key roles in choosing the best Bitcoin mining rigs. Let’s see what’s out there and which machines offer the best value.

List of the Top Bitcoin Mining Machines in 2024

- Bitmain Antminer S19 XP Hydro – Water-cooled, 255 TH/s Miner

- Bitmain Antminer S21 – 200 TH/s High-Efficiency ASIC

- MicroBT WhatsMiner M56S – 212 TH/s Water-Cooled Miner

- Bitmain Antminer S19 XP – Customizable 140 TH/s ASIC

- Bitmain AntMiner S19k Pro – Mid-Price 136 TH/s Miner

- Canaan Avalon Made A1366 – Quiet-Running 130 TH/s ASIC

- MicroBT Whatsminer M50S – Affordable 126 TH/s Miner

- Bitmain Antminer S19j Pro+ – Beginner-Friendly 122 TH/s ASIC

- MicroBT WhatsMiner M30S++ – Low-Cost 112 TH/s Miner

- Bitmain AntMiner T19 – Time-Tested 84 TH/s ASIC

Top Bitcoin Mining Rigs Reviewed

We compared specs and features for the best Bitcoin mining hardware to see which ones came out on top. Profitability varied from less than a dollar per day to more than $15 daily based on an average electricity cost ($0.11 per KWh), current mining difficulty, and the current Bitcoin price (about $72,000 at press time).

Mining hardware that produces a marginal profit could still be viable if you expect Bitcoin prices to maintain an upward trajectory. However, the cost of the rig itself should also be considered when choosing the best Bitcoin mining hardware for your specific use case.

Note: Much like Bitcoin’s price itself, Bitcoin miner prices are volatile. The hardware prices below are offered as estimates and could change frequently.

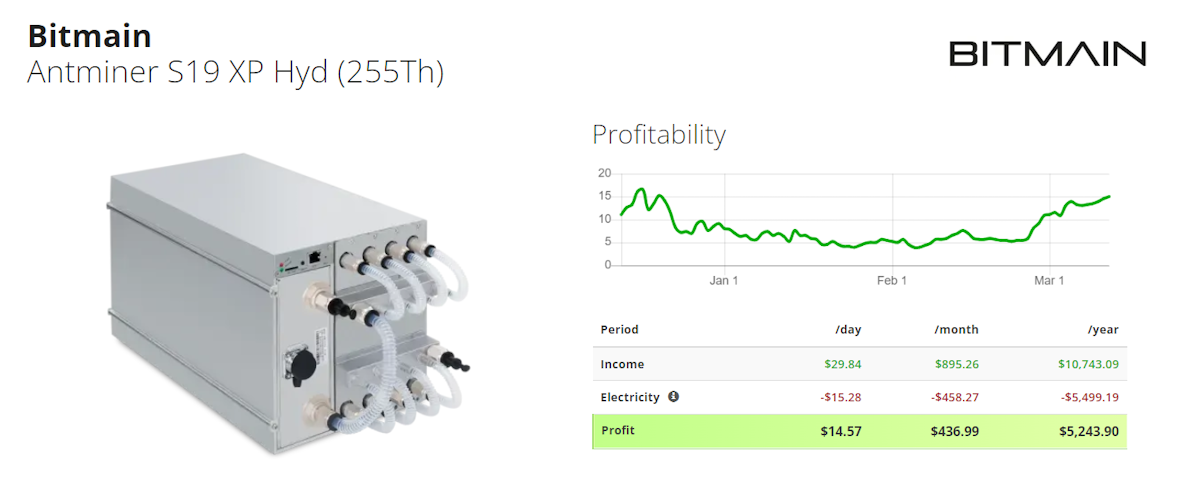

1. Bitmain Antminer S19 XP Hydro

With its chart-topping 255 terahash per second mining output, the Bitmain Antminer S19 XP Hydro has become a popular choice for Bitcoin miners worldwide. Based on an electricity cost of $0.11 KWh, this ASIC miner is capable of more than $15 in profit daily at today’s Bitcoin price. However, at more than four times the cost of the most affordable miner in our lineup, the added productivity becomes essential.

The Bitmain Antminer S19 XP Hydro is water-cooled, and while temperature ranges are similar to other mining hardware, noise levels are much lower as a result, measuring about 50 dB. Expect noise levels up to 33% lower compared to other options.

Released in 2022, the Antminer S19 XP Hydro could start showing its age as newer models emerge, but it remains one of the most efficient Bitcoin mining ASICs available today.

Bitmain Antminer S19 XP Hydro Specs

| Price | $4,362 |

| Estimated Daily Profitability | $15.69 |

| Hash Rate (TH/s) | 255 |

| Energy Consumption (Watts) | 5304 |

| Efficiency (J/GH) | 0.021 |

| Cooling Method | Water |

| Noise Level (db) | 50 |

| Temp (°C) | 5 – 40 |

| Release Year | 2022 |

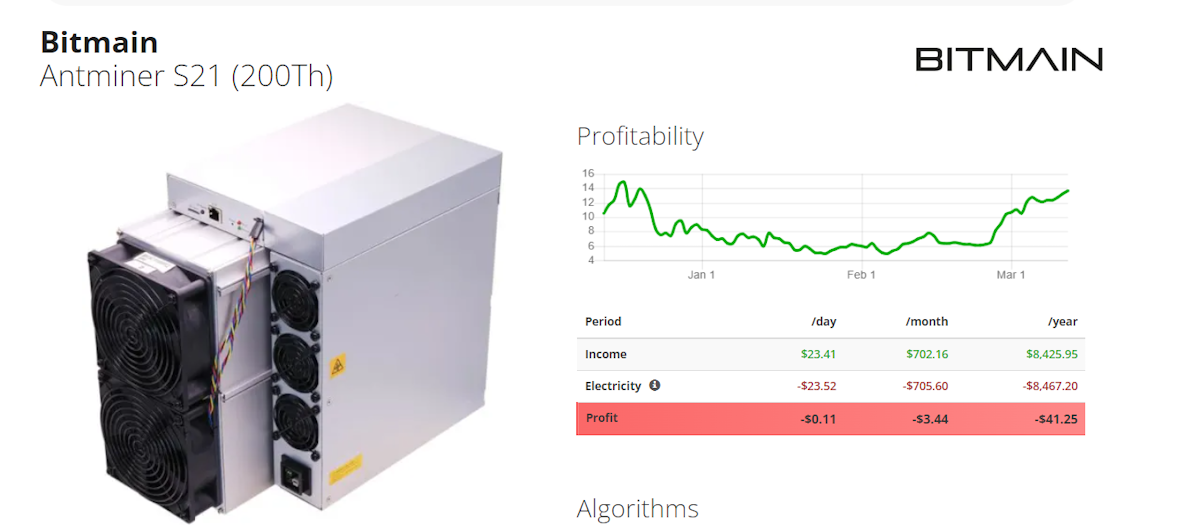

2. Bitmain Antminer S21 200T

Bitmain’s ASICs earn six of the ten top slots in our roundup of the best Bitcoin mining rigs. Efficiency contributes to this dominance, The Bitmain Antminer S21 200T, for example, mines at 0.017 joules per gigahash, making it one of the most efficient miners available today. That efficiency comes at a cost, however. Expect to invest up to $4,000 or more to purchase the Antminer S21 200T.

The Bitmain Antminer S21 200T uses fans for cooling, making it noisier than its hydro-cooled counterparts. Noise levels reach 75 db, which is similar to more affordably priced ASICs in our lineup. Temperature ranges are also similar, with a range from 5 to 40 degrees Celsius. However, the higher end of temps for this ASIC exceed those for the MicroBT WhatsMiner M30S++, a sub $1,000 ASIC released in 2020.

Like the Antminer S19 XP Hydro, Bitmain’s $4,000+ Antminer S21 200T caters to mining operators with a larger budget. However, with this ASIC’s higher-than-average daily profit of more than $14 daily, its breakeven time could be less than a year.

Bitmain Antminer S21 200T Specs

| Price | $4,081 |

| Estimated Daily Profitability | $14.05 |

| Hash Rate (TH/s) | 200 |

| Energy Consumption (Watts) | 3500 |

| Efficiency (J/GH) | 0.017 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 40 |

| Release Year | 2024 |

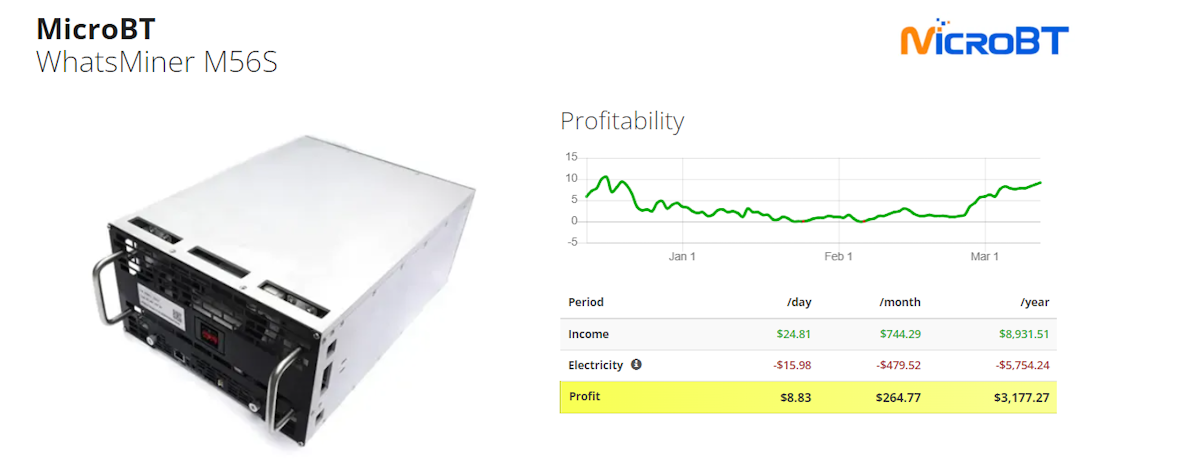

3. MicroBT WhatsMiner M56S

Launched in 2023, the MicroBT WhatsMiner M56S has already earned its place as a favorite for the mining community. The device’s relatively small size and quieter operation make it suitable for both Bitcoin mining at home as well as BTC farms.

Max output is rated at 212 TH/s with power usage of 5,550 watts, giving this ASIC a 0.026 J/GH efficiency rating. While lower than some ASICs in our roundup, this energy rating puts it above older but still popular models like the Bitmain AntMiner T1 and MicroBT WhatsMiner M30S++, both of which are rated for 0.038 J/GH.

Daily profitability reaches just over $10 based on electric costs of $0.11 per KWh. With its $4,000+ estimated cost, the breakeven cost for the MicroBT WhatsMiner M56S could exceed a year, depending on Bitcoin’s price performance and mining difficulty adjustments.

MicroBT WhatsMiner M56S Specs

| Price | $4,064 |

| Estimated Daily Profitability | $10.03 |

| Hash Rate (TH/s) | 212 |

| Energy Consumption (Watts) | 5550 |

| Efficiency (J/GH) | 0.026 |

| Cooling Method | Water |

| Noise Level (db) | 45 |

| Temp (°C) | 5 – 40 |

| Release Year | 2023 |

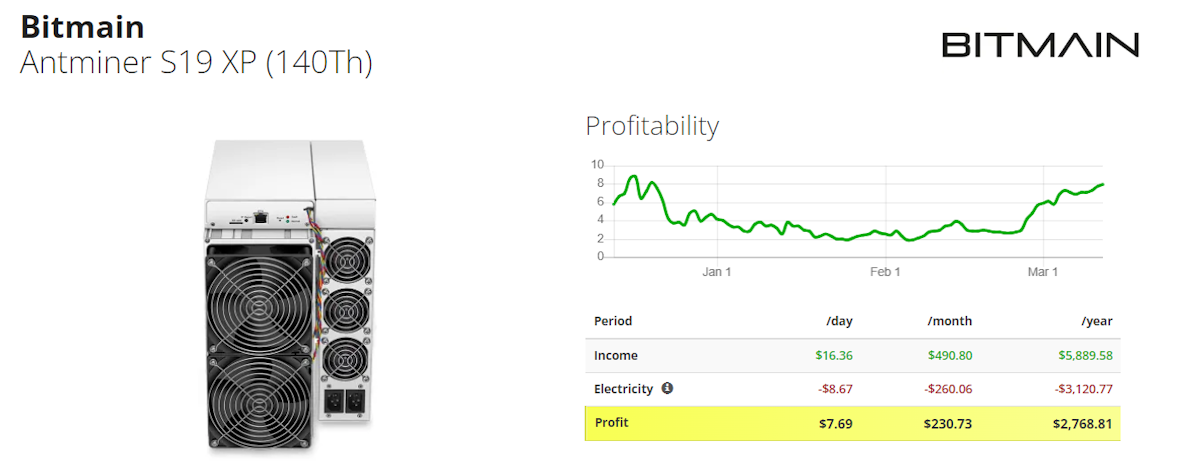

4. Bitmain Antminer S19 XP

Bitmain combines performance with customization options in the Antminer S19 XP. At less than $3,200, the breakeven point comes in less than a year, even with a lower $8.35 daily profit. You can also optimize your Antminer S19 XP further with custom firmware, such as BraiinsOS or LuxOS.

Bitmain’s Antminer S19 XP slightly outperforms its brethren, the more affordable S19k Pro, possibly making it a better value when measuring days to breakeven. We calculated 271 days for the S19 XP compared to 291 days for the S19k Pro. However, the Antminer S19 XP requires a larger upfront investment that’s $1,100 higher than the S19k Pro, putting the purchase cost at about $3,200.

Energy usage for the two units is similar, although the Antminer S19 XP’s enhanced energy efficiency results in higher output per joule of 0.022 J/GH.

Bitmain Antminer S19 XP Specs

| Price | $3,200 |

| Estimated Daily Profitability | $8.35 |

| Hash Rate (TH/s) | 140 |

| Energy Consumption (Watts) | 3010 |

| Efficiency (J/GH) | 0.022 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 45 |

| Release Year | 2022 |

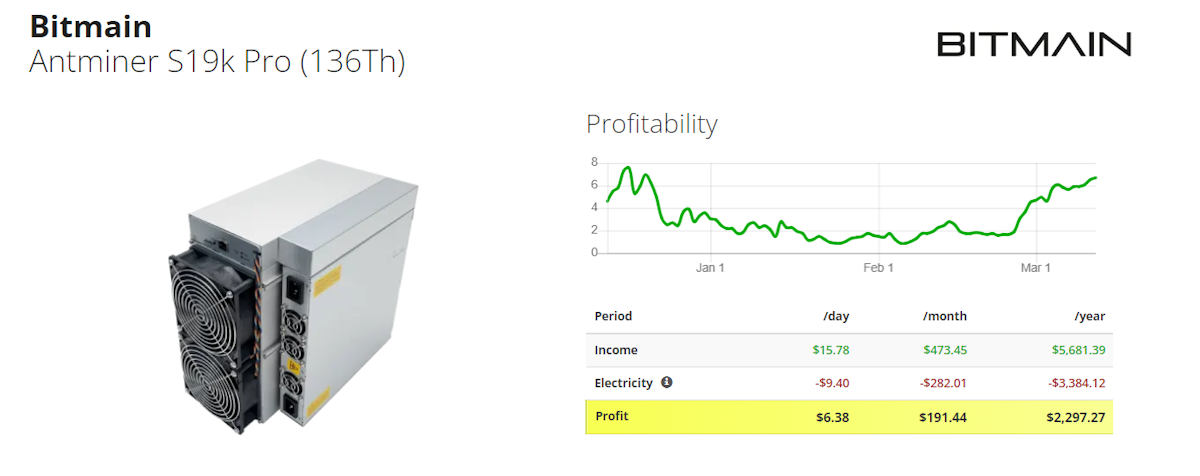

5. Bitmain AntMiner S19k Pro

Released after the S19 XP, the Bitmain AntMiner S19k Pro brings a lower price point while still offering respectable hash power. Based on $0.11 per KWh power rates, the S19k Pro can generate more than $7 daily at today’s Bitcoin price — or $2,600+ annually. If the market stays strong, breakeven could come in less than a year.

A budget-friendly price point combined with its 136 TH/s hash rate makes the AntMiner S19k Pro a popular choice for miners on a budget who need longevity from their hardware. The AntMiner S19k Pro was released in September 2023, making it one of the newer ASICs available at this price point.

S19k Pro ASICs autotune to improve efficiency once running, adjusting the voltage to optimize efficiency based on real-time output with the stock firmware.

Bitmain AntMiner S19k Pro Specs

| Price | $2,100 |

| Estimated Daily Profitability | $7.22 |

| Hash Rate (TH/s) | 136 |

| Energy Consumption (Watts) | 3264 |

| Efficiency (J/GH) | 0.024 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 45 |

| Release Year | 2023 |

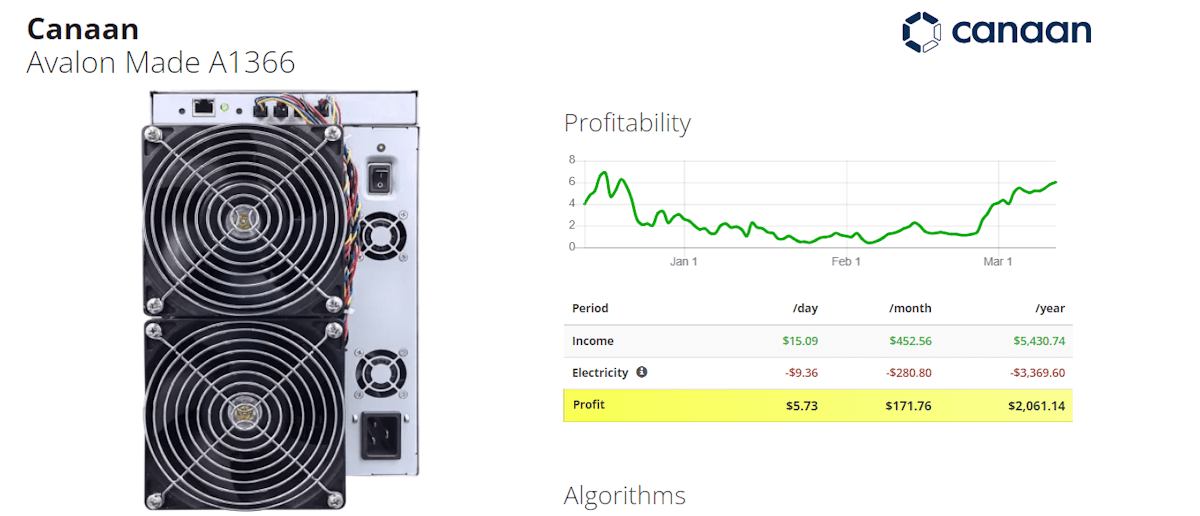

6. Canaan Avalon Made A1366

At about $3,100, the Canaan Avalon Made A1366 is priced just north of mid-pack in our roundup. While noise levels can reach 75 db at max performance, this ASIC also supports what Canaan calls “normal mode,” which reduces fan noise considerably, putting it on par with the noise levels found with high-end gaming rigs. The tradeoff comes in hash rate, which also drops about 25% in regular mode. However, for the home-based miner operator, the tradeoff may be worthwhile for the benefit of peace and quiet.

The Canaan Avalon Made A1366 supports Bitcoin mining as well as BCH, both with similar daily profits of about $6.50 after electricity costs. Top mining pools are also supported, including AntPool and F2Pool.

The A1366’s price point at nearly $3,100 pushes the breakeven point out further to 473 days. However, for miners who value comparatively quiet operation, the investment may make perfect sense.

Canaan Avalon Made A1366 Specs

| Price | $3,099 |

| Estimated Daily Profitability | $6.56 |

| Hash Rate (TH/s) | 130 |

| Energy Consumption (Watts) | 3250 |

| Efficiency (J/GH) | 0.025 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 35 |

| Release Year | 2022 |

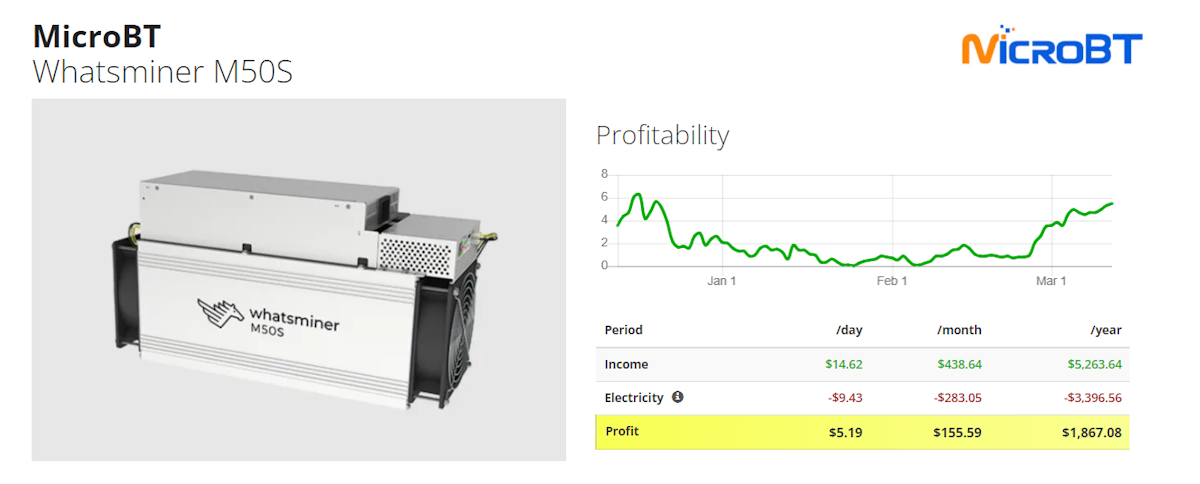

7. MicroBT WhatsMiner M50S

MicroBT takes three slots in our best Bitcoin mining hardware roundup, with the WhatsMiner M50S priced closer to the lower end of the range. This $2,200 ASIC compares well with the Bitmain AntMiner S19k Pro and Canaan Avalon Made A1366, although daily profitability comes in a bit lower in comparison.

The WhatsMiner M50S produces an estimated $6.02 at today’s Bitcoin price and difficulty, assuming an electricity cost of $0.11 per KWh. Given the $2,235 price tag, that puts breakeven at 371 days, less than half the time needed to recoup the cost of the least expensive ASIC in our roundup, the MicroBT WhatsMiner M30S++.

This 2022 ASIC still holds its own today, hashing at up to 126 TH/s with a mining efficiency of 0.026 joules per gigahash. As expected at this price point, operating temps can run a bit higher, reaching as high as 45 degrees Celcius, and noise levels reach the higher range as well at up to 75 db.

MicroBT WhatsMiner M50S Specs

| Price | $2,235 |

| Estimated Daily Profitability | $6.02 |

| Hash Rate (TH/s) | 126 |

| Energy Consumption (Watts) | 3276 |

| Efficiency (J/GH) | 0.026 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 45 |

| Release Year | 2022 |

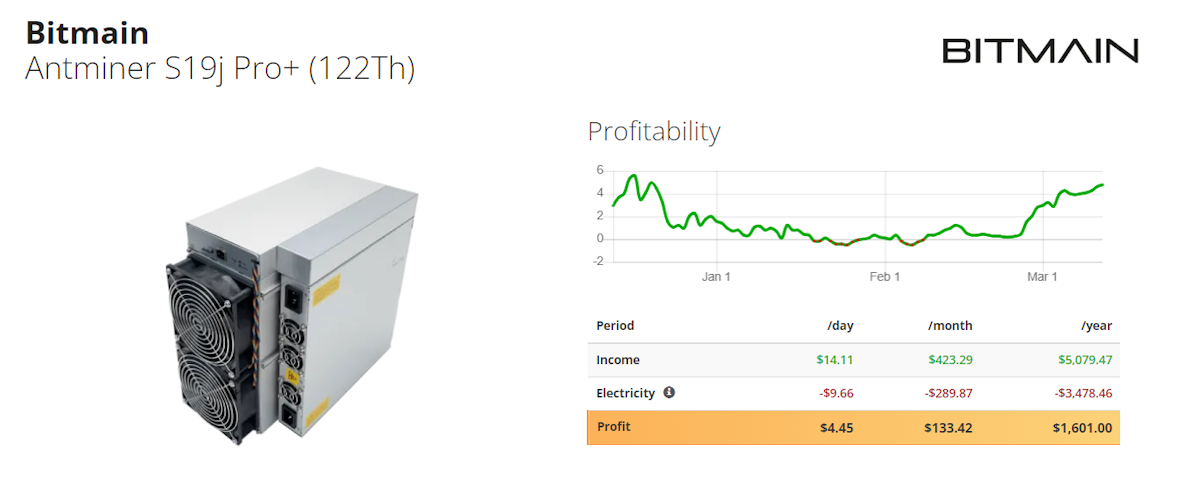

8. Bitmain Antminer S19j Pro+

Aimed at hobbyist miners, the Antminer S19j Pro+ delivers competitive hash power with an affordable $1,500 price tag. This December 2022 model prints $5.35 in daily profit with $0.11 KWh electricity costs. While daily revenue is considerably lower compared to top-tier ASICs that triple that output, the Antminer S19j Pro+ reaches payoff in just 282 days due to its low price relative to daily profit.

Easy setup makes the S19j Pro+ well-suited for novice miners who value a no-fuss startup. Choose from nine coins in addition to Bitcoin, allowing you to switch mining to other coins that may offer more efficient mining. Supported mining pools include ViaBTC and AntPool.

This ASIC hashes at up to 122 TH/s with energy efficiency rated at 0.028 joules per gigahash. While not the most powerful miner in our roundup, the S19j Pro+ holds its own at this price point, far outpacing sub-90 TH/s miners like the older Bitmain AntMiner T19.

Bitmain Antminer S19j Pro+ Specs

| Price | $1.513 |

| Estimated Daily Profitability | $5.35 |

| Hash Rate (TH/s) | 122 |

| Energy Consumption (Watts) | 3355 |

| Efficiency (J/GH) | 0.028 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 45 |

| Release Year | 2022 |

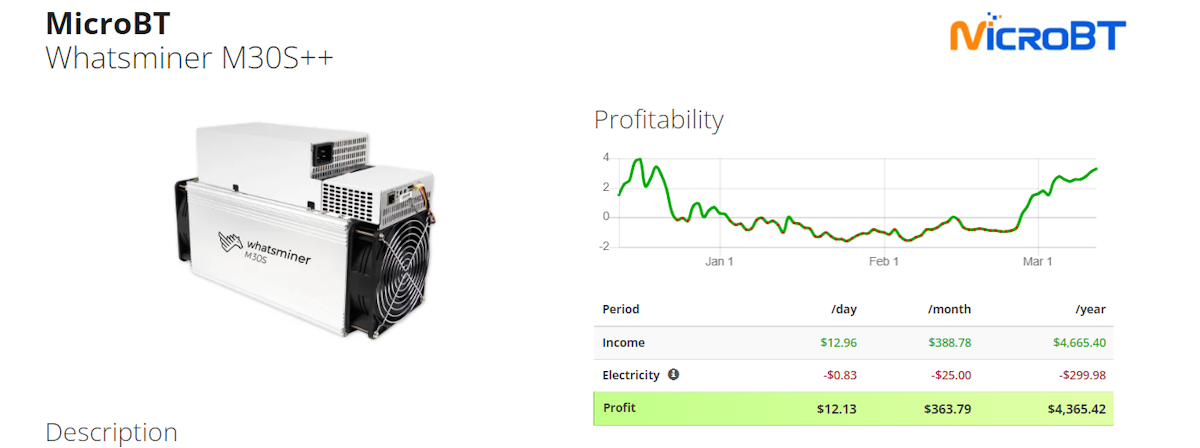

9. MicroBT WhatsMiner M30S++

The latest miners aren’t always the best value, as evidenced by the WhatsMiner M30S++. Released in 2020, this bargain-priced ASIC can still hash its way to more than $4 in daily profit. At under $1,000 from some retailers, that level of output puts the breakeven date 238 days away at current Bitcoin prices.

MicroBT’s WhatsMiner M30S++ isn’t as efficient as some of the other choices in our lineup, but it’s worthwhile to consider efficiency relative to cost. At 0.031 joules per gigahash, the M30S++ is one of the least efficient in our roundup, but it’s also the most affordable.

The price/performance ratio for the M30S++ makes it well-suited to novice miners, those looking for a first ASIC, or anyone who wants to mine at 100+ TH/s without spending a mint.

MicroBT WhatsMiner M30S++ Specs

| Price | $978 |

| Estimated Daily Profitability | $4.10 |

| Hash Rate (TH/s) | 112 |

| Energy Consumption (Watts) | 3472 |

| Efficiency (J/GH) | 0.031 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 40 |

| Release Year | 2020 |

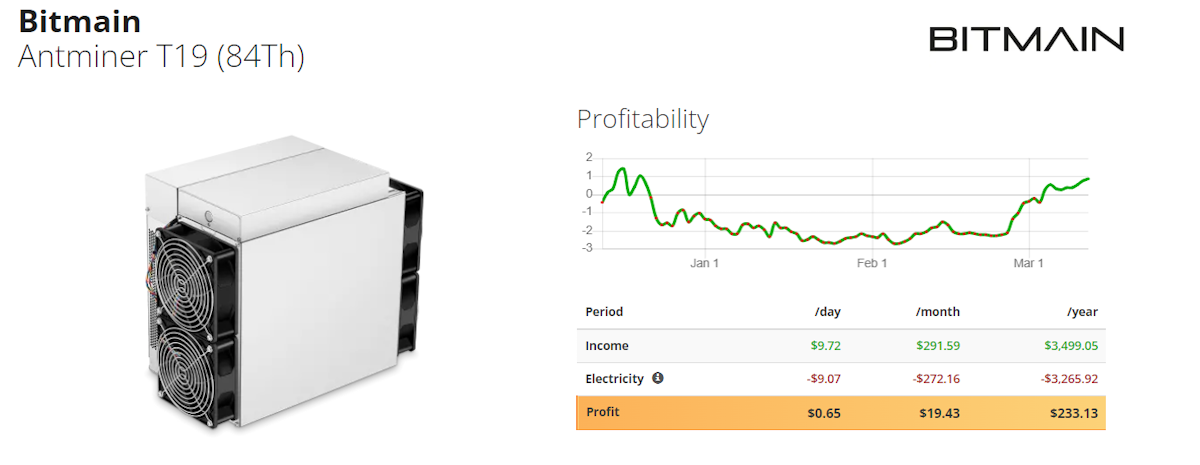

10. Bitmain AntMiner T19

First launched in 2020, the Bitmain AntMiner T19 can still turn a profit today. However, the lower daily profit common to older ASICs leaves less room for error. A dip in the price of Bitcoin can easily turn a profit into a loss. It happens. In 2022, Bitcoin’s price fell by as much as 64% from its all-time highs.

This budget-friendly $1,400 miner hashes at up to 84 TH/s for a daily profit of about $1.46 at $0.11 per KWh energy costs. Overall mining efficiency pushes daily performance down. The AntMiner T19 has an efficiency rating of 0.038 joules per gigahash, about half the efficiency of the Bitmain Antminer S21 200T (0.017 J/GH).

At this end of the market, expect to mine longer before recouping hardware costs. At $1.46 profit per day, the T19 will take more than 2.5 years to pay for itself. Merge mining of other supported cryptos, such as Namecoin and Syscoin, can help aspiring miner+s reach breakeven sooner.

Bitmain AntMiner T19 Specs

| Price | $1,400 |

| Estimated Daily Profitability | $1.46 |

| Hash Rate (TH/s) | 84 |

| Energy Consumption (Watts) | 3150 |

| Efficiency (J/GH) | 0.038 |

| Cooling Method | Fans |

| Noise Level (db) | 75 |

| Temp (°C) | 5 – 40 |

| Release Year | 2020 |

What is a Bitcoin Mining Rig?

A Bitcoin mining rig refers to specialized hardware that’s optimized for the Bitcoin mining algorithm. Today, many miners choose an application-specific integrated circuit (ASIC) to do the heavy lifting, paired with a capable computer and specialized software designed for Bitcoin mining. ASICs provide hash rates often in the hundreds of terahashes per second.

In Bitcoin’s early days, you could mine bitcoins with CPU power due to the lower mining difficulty at the time. Eventually, high-end graphics cards (GPUs) became the way to mine profitably as mining difficulty increased. CPU and GPU mining are no longer considered profitable to mine Bitcoin at scale, although many hobbyists still use both to mine various proof-of-work cryptocurrencies.

Field-programmable gate arrays (FPGAs) offer an intermediate step above GPU mining but still lag behind the best ASICs in performance. And even ASICs that were popular a few years ago may not be up to the task as mining difficulty increases. Bitcoin mining is a race to the top with three key metrics: hash rate, energy efficiency, and hardware cost.

How to Choose a Bitcoin Mining Rig

With prices for ASIC miners ranging from under $1,000 to more than $4,000, it’s important to consider your priorities. For some, hash rate is the top consideration. For others, price or overall efficiency may be the driving factor. Here are some of the key factors to consider when choosing the best Bitcoin mining hardware for your specific needs.

Hash Rate

Bitcoin mining hardware in our roundup has hash rates ranging from 84 TH/s up to 257 TH/s. Higher is better, although you also need to consider power usage as well. A miner that doubles the hash rate compared to another miner but which triples the energy usage may not be more profitable.

Energy Efficiency

Like hash rate, energy usage has to be viewed in the context of how productive the miner is. Most mining hardware suppliers offer a way to compare ASICs using joules per terahash (J/TH) or joules per gigahash (J/GH). Lower is better, meaning the rig uses less energy per terahash than other choices.

The US Energy Information Administration estimated that Bitcoin mining in the US represents up to 2.3% of US electricity usage. More efficient mining isn’t just better for mining profits; it’s better for everyone.

Mining Hardware Type

The best Bitcoin mining machines use FPGAs or ASICs. FPGAs provide the flexibility to change the mining algorithm, at least in theory. You’d have to rebuild the circuit design. Most mining rig operators won’t want to or won’t be able to change the algorithm for an FPGA. From an efficiency point of view (J/TH), ASICs still come out on top for Bitcoin mining.

You also have the choice of air cooling or hydro cooling. However, this is a feature built into the ASIC itself rather than an upgrade. Air-cooled ASICs use heat sinks and fans, whereas hydro-cooled ASICs use a closed-loop liquid cooling system in addition to fans. ASICs can create massive amounts of heat, possibly making the space very uncomfortable. Some see a hydro-cooled ASIC as a worthwhile investment.

Price

The cost of a miner typically corresponds to hash rate or energy efficiency measured in joules per terahash or joules per gigahash. However, you’ll also want to estimate the mining time required to recoup your purchase. Several options in our roundup let you pay off your miner investment in under a year. However, the cost of some Bitcoin mining rigs can take much longer. If electricity costs are higher in your location, this can push the breakeven point out even further.

Upgradability

You may also want to consider the upgradability of the hardware on your wish list. Some ASICs support third-party firmware, for example. However, hardware upgrades are typically limited to fans and power supplies.

- Firmware updates: Firmware is software that controls hardware functions. ASIC manufacturers provide default firmware with occasional updates, but third-party firmware may allow you to make your ASIC more productive. For example, Awesome Miner provides firmware updates for dozens of Antminer models, promising to improve the hash rate by up to 40%.

- Cooling systems: You may be able to upgrade the fans or other cooling systems for your miner.

- Power supply: Some third-party firmware upgrades may require an upgraded power supply.

- Heatsinks: You may be able to upgrade the heatsinks in certain ASICs, potentially providing better heat dissipation to protect the miner’s hash board.

Algorithm

For Bitcoin mining, you need an ASIC compatible with Bitcoin’s SHA-256 mining algorithm. Think of ASICs as purpose-built hardware; they do one thing extremely well. ASICs made for other proof-of-work algorithms won’t mine Bitcoin, and the algorithm for an can’t be changed. A firmware update might increase efficiency, but can’t turn a Litecoin Scrypt ASIC into a Bitcoin SHA-256 ASIC.

While ASICs can’t be repurposed for other algorithms, you may be able to mine other SHA-256 cryptocurrencies concurrently or switch to another compatible cryptocurrency if Bitcoin mining becomes unprofitable due to a price dip or increased mining difficulty.

How Profitable are Bitcoin Mining Machines?

Bitcoin mining profitability has fallen dramatically since 2015, largely due to increased competition, which then leads to increased mining difficulty. On the other hand, Bitcoin mining revenue is now at record levels, reaching nearly $79 million daily.

In this guide, we prioritized mining rigs that can turn a profit today. Our top picks can produce up to $15+ per day in profit per rig based on current BTC prices.

However, many Bitcoin miners consider the potential future price of Bitcoin, making it a speculative investment. Mining at breakeven or even a loss could turn a profit if you’re willing to wait for the market to catch up and can cover the ongoing costs of mining.

A simple way to determine profitability involves comparing hash rate to energy consumption, with the first representing income and the second representing expense. But you also have to consider the cost of the hardware and how long it will last. In addition, you have to consider the price of Bitcoin.

ASICs provide the best profitability metrics but also represent a sizeable investment. The best Bitcoin mining rigs, when measured by hash rate, can cost upwards of $5,000 each. The typical lifespan of modern ASICs can reach five years or longer, although whether the hash rate will still be competitive in five years is guesswork.

Elements of Mining Profit Calculations

These are the elements to consider to determine Bitcoin mining profitability.

- Hash rate output: Bitcoin mining is really a process of hashing, using the Bitcoin mining algorithm to generate hashes until you or your mining pool finds a block. Higher hash rates increase the odds of finding a block sooner. When mining to a pool, your hash rate affects your share of the mining reward.

- Pool fees: Bitcoin mining pools aggregate the hashpower of multiple miners allowing you to earn mining rewards faster compared to solo mining. Some pools charge a fee that can reach as high as 4%, although 2% is closer to the average.

- Network and exchange fees: To sell the bitcoins you’ve mined, you have two additional costs: network costs to send the bitcoins to an exchange and exchange trading fees. Depending on which exchange you choose, these can be less than 0.5% combined.

- Bitcoin value: BTC’s market price also plays a role. You may want to time your trades to catch an upswing using technical chart indicators.

- Electricity costs: The cost of electricity varies depending on your location. Electricity costs should be weighed relative to mining equipment efficiency. High energy usage for mining hardware may still work if your miner’s hash rate is also correspondingly high.

- Equipment cost: It’s often best to treat your equipment as a capital expense, taking the cost into account over its expected productive lifetime. For example, if you spend $2,400 on an ASIC that you expect to be profitable for two years, the cost of the ASIC would be $100 per month.

- Merge mining income: Merge mining refers to contributing proof of work to multiple compatible blockchains. While mining Bitcoin, you may also want to mine Namecoin, Syscoin, and Crown, all of which support merge mining to generate additional income.

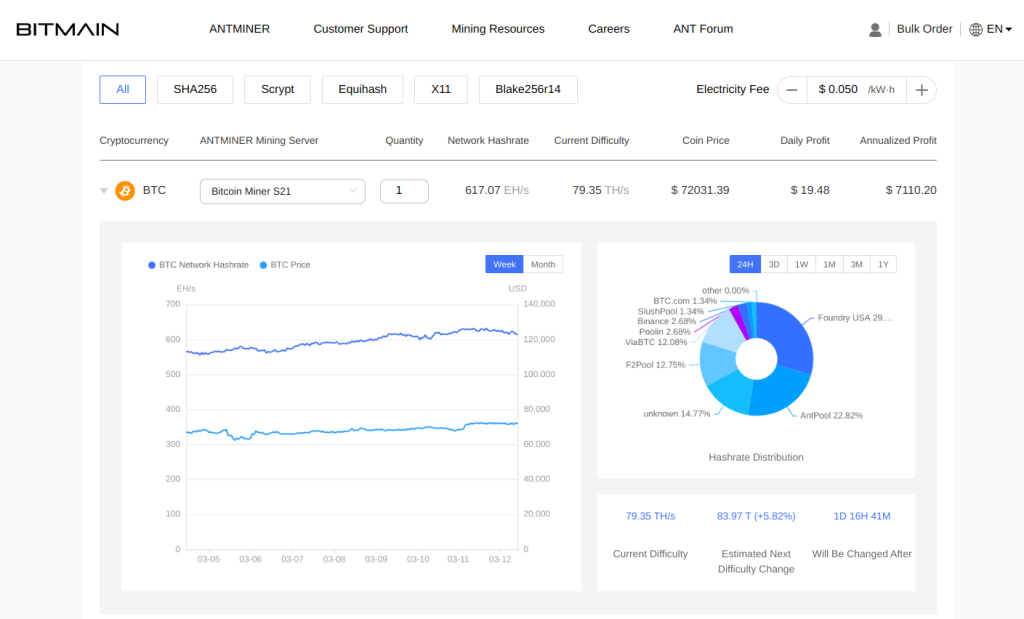

Calculating Mining Profitability

We can simplify some of the above for some back-of-the-napkin calculations using three numbers, miner cost, electricity cost, and BTC income. Let’s start with the cost of the mining equipment itself, assuming that you already have a computer with sufficient RAM. As a practical matter, a $50 used i5-powered ThinkPad purchased off eBay is sufficient to run most mining software.

For this example, we can use the Bitmain AntMiner T19, which costs about $1,400. Assuming a 2-year productive life, this gives us the first expense: $700 annually. Power consumption for this ASIC is rated at 3,150 watts. Assuming electricity costs of 9 cents per KWh, annual electricity costs would be about $2,450.

That gives us an estimated $3,150 in annual expenses. The Antminer T19 can produce 84Th, mining about $3,360 worth of BTC each year at current prices and at the current difficulty level. $3,360 – $3,150 = $210 profit annually.

This simple calculation doesn’t account for pool fees or exchange fees. However, it also doesn’t consider potential merge-mining income.

Many mining pools offer a mining profitability calculator that allows you to choose your hardware and adjust electricity costs. Minerstat also provides a detailed mining profitability calculator, as does Bitmain, a major mining supplier. The Bitmain mining calculator also calculates how many mining days are required to recoup your hardware investment.

How Much Does Bitcoin Mining Hardware Cost?

ASICs in our lineup range in price from just under $1,000 to over $4,000. As a less expensive alternative, you can also consider an FPGA. However, FPGAs are generally less efficient compared to ASIC, the latter of which is built for mining a specific algorithm. In effect, you may lose the initial cost savings to reduced mining efficiency over time.

The cost of a computer to run the miner should be minimal of paired with an ASIC. An older used laptop is likely up to the task of running mining software, adding $50 to $100 to the cost to get started.

In some cases, you may also need to upgrade the electrical service where your miner will be running. For example, in the US, home panels can often only support light GPU-based mining without upgrades. Local building codes may make ASIC mining impossible due to panel restrictions. However, if you do have the option to upgrade electrical service, hiring an electrician and getting permits could add $2,000 or more to startup costs. If you’re fortunate enough to have adequate electrical service in your mining location, the cost of mining hardware is largely limited to the ASIC itself.

Other considerations include additional cooling and ventilation. Bitcoin mining generates an uncomfortable amount of heat, often necessitating fan upgrades as well as other heat mitigation measures. You also may want a hardware crypto wallet to protect the bitcoins you mine.

Conclusion

Bitcoin mining can be fun and profitable. To maximize your profit, you’ll want to consider one of the best Bitcoin mining machines. Fortunately, mining hardware has become more affordable at the low end while still giving you options if you need to maximize your hash rate.

Bitmain ASICs still dominate the space, but competitors like Canaan and MicroBT WhatsMiner models offer a compelling value as well. Research your choice carefully and look into additional investments you might need to make, such as electrical upgrades or mining software.

FAQs

What is the best hardware for mining Bitcoin?

Bitmain ASIC Bitcoin mining machines offer the widest range of hardware and feature many of the best Bitcoin mining rigs on the market today.

Which Bitcoin mining hardware has the highest hash rate?

In our roundup, the Bitmain Antminer S19 XP Hydro scored highest for hash rate, reaching a maximum of 255 terahashes per second using the stock firmware.

Is Bitcoin mining still profitable?

Bitcoin mining can still be profitable with the right mining hardware. ASICs can still turn a daily profit at Bitcoin’s current market price. However, ASICs with higher hash rates provide more room for price fluctuations. Lower-end ASICs can fall into a loss faster due to a lower hash rate.

Are Bitcoin mining rigs legal?

Bitcoin mining is legal in most parts of the world. However, it’s important to research your local laws and regulations before making an investment. In some cases, zoning restrictions regarding electrical service can create an obstacle.

How much does it cost to build a Bitcoin mining rig?

Assuming you already have electrical service up to the task, you can get started with Bitcoin mining for less than $1,500. An older ASIC from 2020 can still be profitable and can cost as little as $1,000. Computer requirements are minimal, making an inexpensive used computer suitable for running mining software.

How long does it take to mine 1 bitcoin?

With a single miner, it can take several years to mine 1 Bitcoin. For example, the Antminer S19 XP Hydro mines 255 terahashes per second. Given the current mining difficulty, the S19 XP Hydro would mine one bitcoin in about seven years.

References

- Tracking electricity consumption from U.S. cryptocurrency mining operations (eia.gov)

- Awesome Miner Antminer Firmware (awesomeminer.com)

- Mining profitability calculator (minerstat.com)

- Mining Profit Calculator (bitmain.com)

- Mining profitability of Bitcoin per day from July 2015 to January 14, 2024 (statista.com)

- Bitcoin Mining Daily Revenue Hits Record as Token’s Price Surges (bloomberg.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi

Michael Graw

Michael Graw