How to Create a Cryptocurrency in 9 Simple Steps

If you’re curious about how to create a cryptocurrency, you’re in good company. Since 2014, crypto data aggregator CoinGecko has tracked more than 24,000 cryptocurrency projects. More than half of these have fallen to the wayside, underscoring the importance of having a solid plan and tight execution.

Fortunately, you have some advantages over Satoshi, the person or group that brought us Bitcoin, and other early projects that had to put the pieces together the first time. We can follow their lead, using tested blockchain technology to solve a new problem or building a new cryptocurrency just for fun (and science).

The good news is that if you want to learn how to create a cryptocurrency, it doesn’t have to be rocket science. Simpler projects, like creating tokens on existing blockchains, can be completed in minutes. If you want to start a new blockchain project you’ve got some work ahead of you.

Let’s learn how to create your own cryptocurrency following nine steps. Which steps you’ll need to complete depends on your goals for your new crypto. Let’s get started.

How to Make Your Own Cryptocurrency

Not every existing cryptocurrency has a unique use case or offers an improvement. However, if you’re interested in learning how to start a cryptocurrency and you want your digital asset to be more than a pet rock (that cryptocurrency already exists), then you’ll need to consider how it creates value for users and investors.

Next, you’ll need to consider where your crypto will live. Crypto coins run on their own blockchain, a decidedly more challenging way to create a cryptocurrency. Crypto tokens however, exist on already established blockchain platforms. A token can be much easier to create, and the existing blockchain takes care of transactions for your token.

If your cryptocurrency is a coin (using its own blockchain), other steps to consider include creating nodes to validate transactions and a wallet for your cryptocurrency. Good news here as well. Most blockchain projects are open-source, meaning you can fork the existing code of an established blockchain and add or remove features to make your own unique blockchain. BSC, one of the largest blockchains, got its start as a fork of Ethereum. Similarly, Litecoin was a fork of Bitcoin — and Dogecoin was a fork of Litecoin.

1) Defining the Purpose of Your Crypto Coin

Why does the world need your cryptocurrency? What problem does it solve? These are questions that need to be answered before you invest resources into the project. Of course, if you just want to create a crypto for fun, that could be the answer. Bonk, a popular dog-themed meme token on the Solana chain, does nothing at all. It’s just fun.

To consider more serious projects, Satoshi penned the Bitcoin Whitepaper before launching the project, detailing a Peer-to-Peer Electronic Cash System and how such a system might work. It’s only nine pages long. Start there for inspiration.

Similarly, Vitalik Buterin, one of the co-founders of Ethereum, authored the Ethereum Whitepaper, which laid out the concept of the Ethereum network and how its native support for smart contracts would bring new functionality to its blockchain.

Today, Bitcoin and Ethereum are the largest cryptocurrencies by market capitalization, partly due to the network effect (inherent value based on the number of users) but also due to a clearly defined vision for each of the projects.

2) Choosing the Right Blockchain Platform

Next you must decide which blockchain your project will be hosted on? Crypto assets that use a host blockchain are tokens rather than coins. Earlier, we mentioned Bonk. It’s a token running on the Solana blockchain. Other examples include Uniswap, in which the UNI token acts as a governance token for the Uniswap decentralized exchange.

Alternatively, you can start a new blockchain, a more adventurous task but not insurmountable. Legend has it that Dogecoin, a top-20 crypto, was created in about two hours by forking Litecoin’s open-source code.

Option 1 – Existing Blockchains

Several well-established blockchains support tokens, and some of today’s independent blockchains began as tokens on other blockchains. For example, Tron is now the second largest smart-contract network by total locked value (TVL), with more than $8.5 billion locked in smart contracts on the network. However, Tron originally launched as an ERC-20 token on the Ethereum blockchain.

To launch on an established blockchain, you’ll probably want to choose a network where tokens are well-supported and existing decentralized exchanges can provide liquidity. A decentralized exchange uses liquidity pools that let users swap token A for token B without using a traditional crypto exchange.

Some common choices include:

- Ethereum: The Ethereum blockchain can bring the most exposure to your token. However, transaction costs run higher than on competing chains. Most smart contracts run on the Ethereum Virtual Machine (EVM). Token Tool offers an easy way to build an Ethereum-compatible token in minutes.

- Arbitrum: The Arbitrum network is a layer 2 network that can execute EVM-compatible smart contracts with lower fees and faster transaction times.

- Polygon: The Polygon network also supports EVM-compatible smart contracts, and Polygon’s still-in-beta zkEVM promises Ethereum-equivalent finality combined with low-cost transactions.

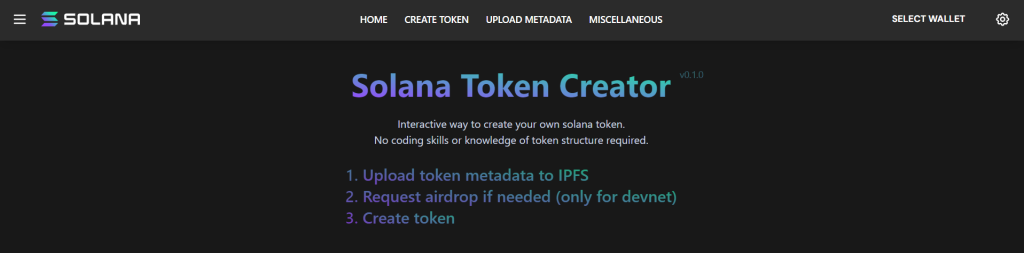

- Solana: Built for speed, Solana enjoys a dedicated community with a growing number of decentralized applications. Solana also offers a Solana Token Creator that lets you get started with no programming.

- Tron: The Tron network’s TRC20 token standard allows blockchain-savvy users to deploy a new token in seven steps.

Option 2 – Build an Entirely New Blockchain

Some use cases may require a completely new blockchain. Fortunately, there’s no need to reinvent the wheel. In many cases, you can adapt the code of an existing blockchain to suit your needs. Tools like WalletBuilders even provide built-to-order blockchains, running from generic to highly customized.

If you choose to fork a project, read up on the license. Some open-source licenses may restrict what you can do with the code, whereas others may offer free rein.

Some commonly forked blockchains:

- Ethereum: With over 18,000 forks (most never deployed publicly), Ethereum is one of the most forked blockchains.

- Bitcoin: Many of today’s leading blockchains, such as Litecoin, borrowed Bitcoin’s code, making changes to achieve specific goals.

- Litecoin: Although Litecoin was a fork of Bitcoin, the Litecoin project has enabled other successful forked projects, such as Dogecoin (forked from Litecoin fork, Luckycoin).

- Kaspa: While a relatively new chain, Kaspa has already attracted a number of forks based on its innovative blockDAG architecture, which processes multiple blocks simultaneously.

If a new blockchain is needed to meet your use case, consider borrowing code or implementations from existing projects. You don’t always need to start from scratch.

3) Choosing a Consensus Algorithm

A consensus mechanism refers to a method of reaching an agreement on the state of the network. Which transactions are valid? What are the wallet balances after a transaction? These are questions that consensus answers. Think of consensus as a set of rules to secure the network’s transactions.

Among the most common consensus mechanisms, Proof of Work (PoW) and Proof of Stake (PoW) remain the leading solutions. Notably, Solana combines Proof of Stake with Proof of History (PoH) to process transactions quickly. Other choices include Proof of Authority (PoA) and delegated Proof of Stake (dPoS).

Let’s examine the leading types of consensus mechanisms: Proof of Work and Proof of Stake.

- Proof of Work: PoW blockchains require mining nodes to solve an algorithm puzzle, expending time and computational resources as a way to secure the network. In simple terms, it costs a lot of power and money to mine a new block, making it impractical to attempt to change a transaction in a prior block. Bitcoin uses PoW, as do Litecoin, Dogecoin, and Kaspa.

- Proof of Stake: PoS uses cryptocurrency to secure the network by requiring a “stake” as collateral. Nodes that don’t follow protocol may see their stake “slashed,” meaning the node operator could lose their investment. A variation of PoS called delegated proof of stake (dPoS) allows users to assign their tokens to an approved validator. The Tron network uses DPoS, whereas Ethereum uses PoS.

Both consensus methods pay a reward to nodes for securing the network. Which consensus mechanism you choose may depend on your use case goals but will also likely depend on where you launch your token.

If you use an established chain, you’ll be forced to use the consensus method already in use. The existing chain does the work. However, if you fork a chain, you’ll likely use the consensus method already in use for the original chain. Converting a PoW chain to a PoS chain is a major undertaking, although Ethereum made the switch to PoS in 2022.

4) Create the Cryptocurrency’s Node

Nodes are computers on a network that store copies of the blockchain, with some specialized nodes performing tasks like validation (PoS) or mining (PoW).

Again, whether you need to create nodes depends on whether your new cryptocurrency will use an existing network or you’re building one from new. For example, if you’re building an ERC-20 token for an EVM-compatible network, you won’t need to create nodes. The host network completes validation and stores copies of the blockchain. In this case, your token is simply another asset on the network.

If you’re building your own blockchain, however, you’ll need nodes to store and secure transactions. Services like WalletBuilders can create and host nodes for blockchains launched through their service. Alternatively, you can choose a developer with expertise in building new blockchain networks to help you get started. You can also consider a specialized freelance platform like Toptal.

5) Develop and Test Smart Contracts

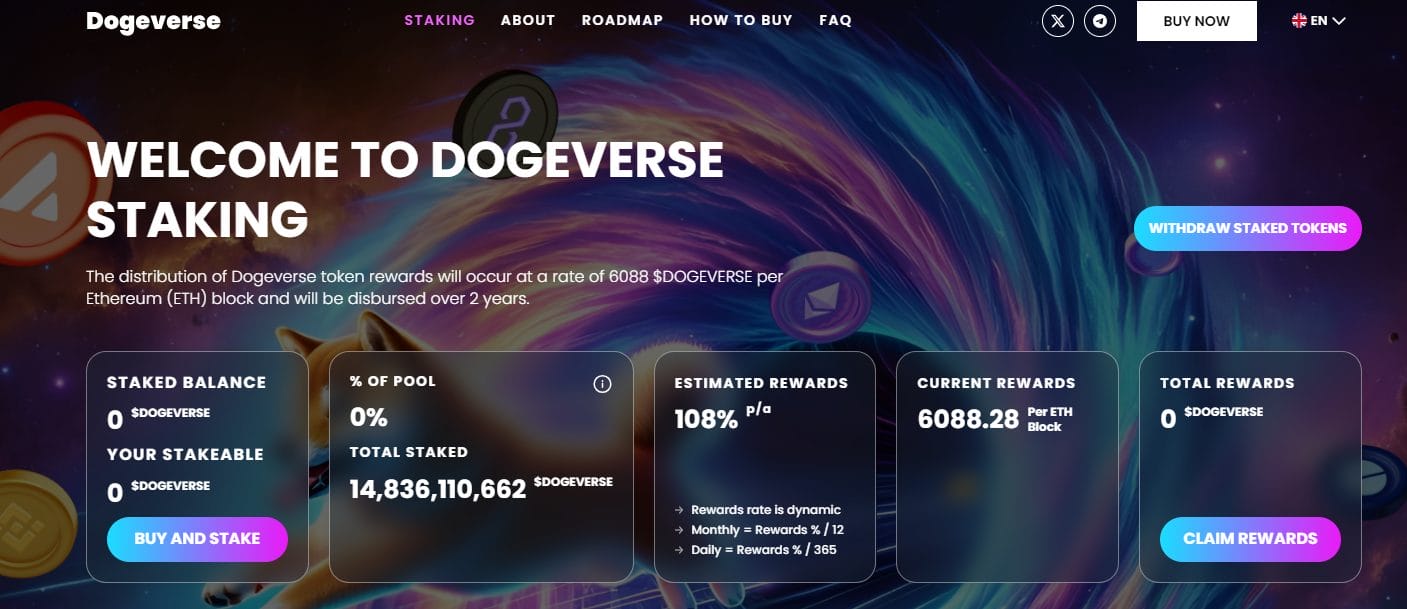

When you launch a token on a host network, the token is actually a smart contract on the blockchain network. These smart contracts work like conditional switches; if this happens, then do that. The token contract defines the rules for the token. These include its supply, name, and symbol, allowing the network to differentiate your token from others. Creating your token contract is also known as “minting” a token.

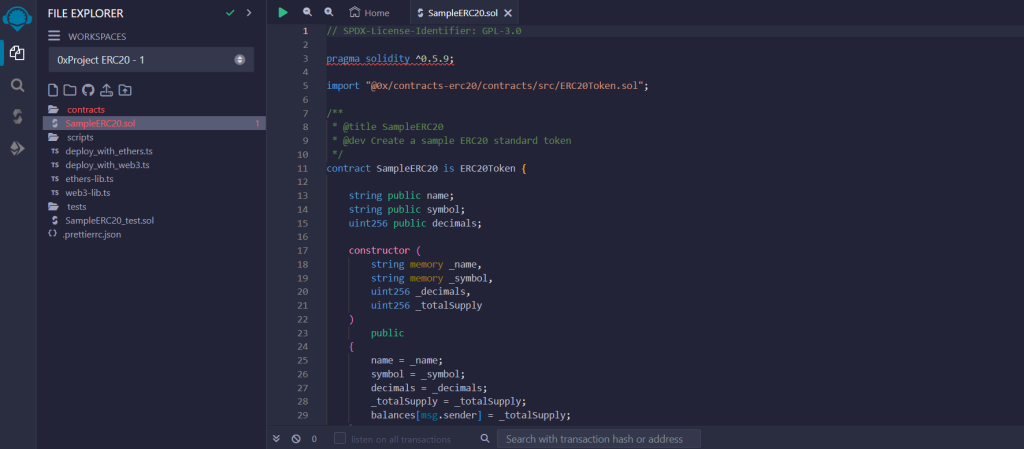

Where you intend to deploy your token makes a difference in regard to the token’s format, as well as the programming language used to build the token. For example, an EVM-compatible token will use the ERC-20 token standard, whereas Solana uses the SPL token standard. Similarly, EVM-compatible token contracts are programmed in the Solidity programming language, while Solana smart contracts use a Rust-based language called Anchor.

Ethereum offers an online tool called Remix to build your contracts. Remix provides templates and plugins to make the process easier and reduce the chance of errors. However, you’ll still want to invest some time in tutorials to learn your way around the integrated development environment (IDE). Remix is handy for building and testing basic features, or you can deploy your code to the Goerli test network for further testing.

You may need other smart contracts as well. For example, perhaps your token will also serve as a governance token used for voting. You’ll need a separate smart contract that supports this application.

Ethereum offers considerable documentation on smart contract testing methods. The key is to test before you deploy. Blockchains are immutable (unchangeable), and while there are some methods to update a deployed smart contract, they can be difficult. It’s much safer to get it right the first time. You may want a third-party audit as well, which we’ll cover in the next section.

Test Networks

In most cases, you can deploy your contracts on a test network before going live on Mainnet. For example, the Goerli test network acts as a testbed for Ethereum contracts. The Goerli network supports Ethereum’s features but uses proof of authority (PoA) as its consensus method. Ether (ETH) to power transactions is available free from several Goerli faucets.

6) Implement Security Measures

In April of 2023, an attacker found a flaw in the configuration of the yUSD token smart contract, allowing the attacker to steal nearly $12 million in stablecoins. This is just one example of a smart contract exploit. 2023 saw an estimated $1.7 billion in stolen crypto funds, with much of the losses historically due to smart contract hacks.

To be fair, hacks suggest breaking into a system, as might happen with a crypto exchange. Most smart contract mishaps are better described as exploits; the code allowed the theft to happen.

For this reason, many projects choose to have a third-party audit. Smart contract audit companies like CertiK and Peckshield have audited many of today’s leading defi protocols. Some service providers can even audit blockchain code. An audit typically uses automated vulnerability scanning followed by a line-by-line code analysis.

Other security measures to employ include multisig wallets to protect treasuries or other project assets. As the name suggests, a multisig wallet requires multiple wallet signatures to approve transactions. You can also consider bug bounties, a reward for white hat hackers and security experts to find potential flaws before disaster strikes.

7) Deploy on Chosen Blockchain

Once you’re certain your project is secure, it’s time to deploy on Mainnet. If you’re using Ethereum as your blockchain, for example, it’s time to move your contracts from the Goerli test network to Ethereum’s Mainnet for immutability. In this case, you can use Remix IDE to deploy to Ethereum Mainnet.

Deploying your coin or token on Mainnet is a milestone in the development of your project and should only be attempted when all checks and stress testing have been completed. Once deployed there is no going back.

8) Creating Wallets and Interfaces

Crypto wallets hold the private keys that control crypto assets (like your new cryptocurrency) on the blockchain.

If you’re creating an ERC-20 token (Ethereum, Abritrum, Base), popular crypto wallets like MetaMask or Rabby can handle transactions for your token. There’s no need to make a new wallet unless you see a branding advantage or want to build features to support your project. For example, the Uniswap decentralized exchange now offers a wallet, although you can also access Uniswap with a compatible wallet such as MetaMask.

If you want to build a new wallet for your app, the AlphaWallet makes a popular starting point, with over 500 forks of its Android wallet and 350 forks of the iOS wallet app.

Front-End Interfaces

If your cryptocurrency is paired with a decentralized application you’re building, consider using a pro for this aspect as well. The front end of decentralized applications acts as inputs and toggles for smart contracts running on the blockchain. You’ll want to ensure the application is bug-free, responsive, and looks great. Some very promising applications never made it to the big time because the app didn’t look professional.

9) Integrating APIs and External Databases

You’ll need to analyze your data needs before building your smart contracts. For example, if your new token is meant to provide governance and incentivize users on a lending and borrowing platform, you’ll need price data from the outside world. Protocols like Chainlink provide oracles that use trusted data sources that can help your new app manage loan-to-value ratios based on real-world price data. However, you’ll need to add support for this earlier in the process, building your smart contracts around this functionality.

However, if you’re launching a new blockchain with your new cryptocurrency, you’ll also need an application programming interface (API), which acts as a data pathway for application developers to build apps or secondary chains for the blockchain. A robust API helps foster a community of developers and innovative apps, making the blockchain more attractive to users.

Marketing and Community Building

Crypto projects live and die based on interaction and a credible presence. Therefore, you’ll want to establish social media channels to build your community. You’ll also need a well-designed website with well-written documentation. The website doesn’t need to be fancy, but it should be appealing and easy to navigate.

The docs are the first thing many users will look for once they discover your project on social media. Be sure to explain the tokenomics (how many tokens and how they are distributed) as well as the goal of the project.

Social media platforms to consider include:

- Twitter (X): The Crypto Twitter community is alive and well, offering one of the best places to spread your message.

- Telegram: The Telegram app is home to several crypto projects, allowing the team to interact with users, answer questions, and share news.

- Discord: The Discord platform lets you set up channels for your project in a more organized way compared to Telegram. However, you might want to use both platforms.

- YouTube: Many crypto projects got their start on YouTube, which offers the ability to share how-to videos. Many users who find you elsewhere will also look on YouTube to see if you have a helpful presence there.

Use these platforms to spread awareness about the project, but also be sure to interact with users. You’ll need trusted ambassadors and moderators for platforms like Telegram and Discord. Both are crypto-community watering holes, but like all watering holes they also attract predators who might try to scam your community members.

Other steps you can take to build engagement include:

- Reaching out to influencers in the community to help promote your project;

- Hosting giveaways;

- Token airdrops for users of similar tokens or projects;

- Collaborating with other projects;

- Hosting AMA (ask me anything) events. Twitter Spaces offers a great forum for this.

Legal Considerations for Starting a Cryptocurrency

Cryptocurrencies are legal in most jurisdictions around the world. However, regulatory agencies are still coming to terms with how and when cryptocurrencies should be regulated.

For example, Bitcoin and Ethereum enjoy a unique position in that the SEC, specifically as the SEC Director of Corporate Finance, William Hinman, publicly opined in 2018 that Bitcoin and Ether are not securities. However, since Ethereum’s change to PoS in 2022, Ether’s status as a commodity could be in peril.

Smaller projects have already lost battles with the SEC, including LBRY, a file-sharing protocol with relatively little funding for a protracted court battle against the US government. LBRY’s token, LBC, has since fallen in value from over $1.20 to $0.0037.

In the US, individual states can also bring suit against crypto projects or platforms.

Study the laws in your country or any other country that might claim jurisdiction. In particular, research the Howey test. In the US, tokens or coins that could appear to be securities, according to the Howey test, have seen the most legal challenges.

Decentralization plays a big role in avoiding being labeled as a security. Many projects choose to manage their token or blockchain using a DAO, a decentralized autonomous organization, giving ownership and control to a worldwide community.

Conclusion

Creating your own cryptocurrency can be relatively simple, in the case of a token, or a massive undertaking if you choose to start a new blockchain. The first step is to clearly define your goals for the project. Next, choose your blockchain. If you’re building your own blockchain network, you’ll also need to choose a consensus method and develop nodes to secure transactions and host decentralized copies of the blockchain.

When deciding how to make your own cryptocurrency, know that the path differs depending on the project’s complexity. Creating a token could take a few minutes, but if that token is to be part of a larger project, there’s much more to consider.

FAQs

Can I create my own cryptocurrency?

Yes there are a few methods to use when searching how to make a cryptocurrency. Several tools like the Solana Token Creator (SPL tokens) and Token Tool (ERC-20 tokens) allow anyone to create a crypto token.

How much does it cost to start a cryptocurrency?

The cost to start a cryptocurrency ranges from nearly free if you’re creating a Solana token or coding your own Ethereum token to $50 and up using Token Tool for ERC-20 tokens. Custom-coded tokens and applications can cost $5,000 and up, depending on the features you need.

Is it legal to create a cryptocurrency?

In most jurisdictions, it’s legal to create a cryptocurrency coin. However, it’s important to study the regulations in your country or any country, state, or province that may claim jurisdiction. Some crypto projects, such as LBRY, have lost in legal battles with the SEC. In the civil case, the SEC alleged that LBRY’s LBC token was sold as an unregistered security.

Can I make crypto for free?

Wondering how to make a cryptocurrency for free? Creating a new token requires gas fees, but tools like Token Tool and Solana Token Creator can make the cost to create your own cryptocurrency token nearly free. Token Tool uses a la carte pricing according to the features you need for your token.

References

- Bitcoin: A Peer-to-Peer Electronic Cash System (bitcoin.org)

- Ethereum Whitepaper (ethereum.org)

- ‘I made doge in like two hours’ (finance.yahoo.com)

- Github – litecoin-project (github.com)

- $3 Billion Blockchain Tron Kicks Off Token Migration (coindesk.com)

- ETHEREUM VIRTUAL MACHINE (EVM) (ethereum.org)

- Create ERC20 Token on Ethereum (tokentool.bitbond.com)

- Polygon zkEVM | Scaling for the Ethereum Virtual Machine (polygon.technology)

- Solana Token Creator v0.1.0 (solana-token-creator.vercel.app)

- Issuing TRC-20 tokens tutorial (tron.network)

- Create your own blockchain (walletbuilders.com)

- About Kaspa (kaspa.org)

- Block Chain (developer.bitcoin.org)

- Consensus (developers.tron.network)

- PROOF-OF-STAKE (POS) (ethereum.org)

- EIP-3675: Upgrade consensus to Proof-of-Stake (eips.ethereum.org)

- Remix Ethereum IDE (remix.ethereum.org)

- TESTING SMART CONTRACTS (ethereum.org)

- Goerli Testnet (goerli.net)

- Hacker exploits old Yearn Finance contract, steals $11.6 mln in stablecoins (finance.yahoo.com)

- Funds Stolen from Crypto Platforms Fall More Than 50% in 2023 (chainalysis.com)

- AlphaWallet / alpha-wallet-android (github.com)

- AlphaWallet / alpha-wallet-ios (github.com)

- Digital Asset Transactions: When Howey Met Gary (Plastic) (sec.gov)

- LITIGATION RELEASES LBRY, Inc. (sec.gov)

- Framework for “Investment Contract” Analysis of Digital Assets (sec.gov)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Kane Pepi

Kane Pepi