Pros and Cons of Accepting Bitcoin as a Business

Bitcoin merchant adoption has been on the rise since the digital currency first started to gain a degree of popularity back in 2011. However, global bitcoin merchant adoption is not yet anywhere near that of credit cards or PayPal.

Major merchant payment provider BitPay claims it processed more than USD 1 billion in bitcoin payments last year and remains profitable in 2018, despite the market slump, the company announced in July. While BitPay’s primary markets are the U.S. and Europe, it has managed to expand into emerging markets through new partnerships.

Meanwhile, another crypto startup Coinbase says that 48,000 businesses has integrated its bitcoin payment solution.

However, the market slump did affect crypto payments this year. After peaking at USD 411 million in September, the amount of money the largest 17 crypto merchant-processing services received in bitcoin has been on a steady decline, hitting a recent low of USD 60 million in May and increasing to USD 69 million in June, Bloomberg reported in August.

However, the same article added that BitPay saw a large uptick in crypto companies paying their vendors in Bitcoin, including law firms, hosting companies, accounting firms, landlords and software vendors in the last six months. Also, bitcoin faithful continue to buy bigger-ticket items such as furniture, and still the occasional sports car. At Overstock.com Inc., crypto-based sales are up two-fold in the first half of this year versus a year ago, the company said. Top items bought with cryptocurrency include living-room furniture, bedroom furniture and laptops, according to the report.

Also, cryptocurrencies are already acting as a store of value and have the potential to be used as a mainstream form of payment within a decade, according to a recent research published by Imperial College London and trading network eToro.

In this article, you will be introduced to the benefits and challenges of accepting bitcoin payments as a business.

Why businesses should accept bitcoin

It is no secret that in the early days of bitcoin many retailers started to accept bitcoin as a marketing ploy to gain publicity for their business. While accepting bitcoin or other cryptocurrencies as a payment method usually does garner positive media attention, there are much more impactful benefits for businesses who accept digital currencies.

The three most prominent benefits of accepting bitcoin as a payment method are the elimination of chargeback fraud, lower transaction fees, and access to the new markets.

Elimination of chargeback fraud

Chargeback fraud is a major issue for online retailers. According to the LexisNexis 2016 True Cost of Fraud study, businesses lose 1.47% of revenue due to fraud and chargeback fraud makes up over a quarter of that. Fortunately, this type of fraud can be eliminated entirely through the acceptance of bitcoin.

Bitcoin transactions cannot be revered by the sender, which means that chargeback fraud is impossible. By enabling bitcoin as a payment method, merchants could reduce their fraud-related losses, which, in turn, could boost their revenues.

Lower transaction fees

Credit card transactions and digital payment processors such as PayPal and Stripe charge between 2 to 4% for transactions. For example, when accepting bitcoin payments, the major merchant payment provider BitPay charges only one percent, while Coinbase claims there is no fee to accept crypto on its platform.

Access to new markets

For internationally operating retailers, accepting bitcoin as a payment method also allows them to enter new markets, especially those where the likes of PayPal and Stripe do not provide their services.

Accepting bitcoin can, therefore, boost revenue not only due to increased publicity but also as it may find new customers in the bitcoin community and in developing regions where traditional payment systems are not widespread.

Challenges for bitcoin-accepting businesses

While the benefits of accepting bitcoin payments should make any retailer consider adopting this payment option, there are also challenges related to accepting bitcoin that need to be addressed.

Price volatility

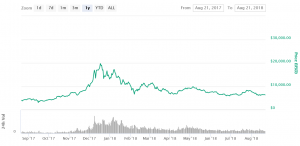

Bitcoin price volatility is decreasing, however it’s still more volatile compared to major currencies such as USD or EUR (but it’s not always the case when it comes to fiat.)

Regulations

Also, changing regulations covering the use of decentralized digital currencies are a risk factor. If a business is operating in a location where cryptocurrencies are banned from one day to the next or there are changes to taxation laws, this could have an adverse effect on the business. Hence, merchants who accept bitcoin will also need to follow any potential regulatory changes on an ongoing basis to ensure they stay compliant.

Change in transaction fees

Secondly, a major issue for bitcoin users in 2017 was the substantial increase in transaction fees. This was felt the most during the digital currency’s price surge to its all-time high in mid-December when bitcoin’s average transaction fees spiked to over USD 50. (Now it’s down to less than USD 1 today, but not many people are using the coins for small transactions, like buying a cup of coffee.)

While the increasing adoption of SegWit and a decrease in bitcoin trading volumes have has slashed transaction fees, there remains a degree of uncertainty of how bitcoin transaction fees will fare in the future. Until further scaling solutions have been implemented for bitcoin, there is a good chance that bitcoin transaction fees will rise again, which would deter shoppers from using the digital currency to make purchases.

That means that purchases from digital currency users could easily drop as fees start to rise again, which could mean a loss of revenue of business who accept bitcoin.