How Ethereum Could Help The Global Economy Recover From A Recession

DeFi applications are accelerating the transition to internet-first, global-first financial infrastructure. Ethereum has a massive head start. People will realize there are things you can do with this new technology that you couldn’t do before.

Ethereum (ETH) has a role to play in the recovery from a coronavirus recession. While the global economy is still waiting for the worst effects of mass lockdowns, layoffs, and losses, Ethereum and its ecosystem of financial platforms are waiting in the wings to make the eventual recovery easier.

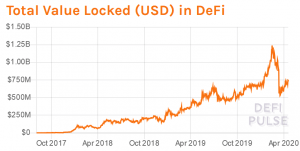

Ethereum already boasts a wide range of DeFi (decentralized finance) platforms that make finance more accessible and efficient for their users. And according to figures working within the Ethereum ecosystem, the decentralization, transparency, openness, and speed of these platforms could play a key role in lubricating the global economy once it gets going again.

That said, the coronavirus outbreak and its resulting recession won’t necessarily have an immediate impact on Ethereum adoption. That will come only with the recovery, necessary improvements of Ethereum itself, and the development of genuine killer apps that solve real problems.

Internet-first, global-first

The coronavirus pandemic is putting growing areas of the globe under lockdown. And even after the worst of the pandemic is over, restrictions on movement may still remain in place for up to a year in various countries.

A year or so of lockdowns or partial lockdowns doesn’t sound all that great. However, as explained to Cryptonews.com by Graeme Moore, the head of tokenization at Polymath Network (POLY), it’s potentially promising for Ethereum and the various DeFi platforms based on the Ethereum blockchain.

“I am a fan of how DeFi applications are accelerating the transition to internet-first, global-first financial infrastructure,” he says. “In a coronavirus-caused recession, who wants to go to a physical bank branch to get a loan? DeFi teams are internet-first, global-first thinking individuals which will make it easier for everyone around the globe to access critical financial infrastructure without leaving their home.”

From tokenization platforms such as Polymath Network and Harbor, to crypto lending platforms like BlockFi and Compound, Ethereum-based DeFi solutions have the obvious advantage that they’re entirely digital. They don’t rely on branches, and can continue serving customers even when we’re all stuck at home.

On top of this, as financial institutions and businesses look to cut down on costs in a post-coronavirus economy, the greater efficiency provided by DeFi platforms may be a big driver of adoption.

“I believe Decentralized Finance will have its moment to shine in a post-coronavirus economy,” says Mariano Conti, the head of smart contracts at MakerDAO (MKR).

“What many of us in the ecosystem already take for granted, like transparency, decentralization, permissionless protocols and fast settlement times, will be sought after by other industries looking to find new opportunities to navigate the impending recession.”

There are already signs that banks, for example, are interested in using blockchain technology to enhance their operations. In a study published by Business Insider in December, 66% and 56% of financial institutions identify “payments” and “securities settlement” as the top two use cases for blockchain-based technology.

Similarly, surveys from PYMNTS.com’s Faster Payments Tracker indicate that a growing proportion of businesses and freelance workers want access to real-time payments and finance.

In other words, there was already a strong appetite for the kinds of benefits Ethereum-based financial products can deliver. And given that much of the world is already experiencing an economic downturn, there’s likely to be an even greater appetite in the coming months, as well as an increased intolerance for legacy financial systems that don’t work as well as they might.

Bond, Ethereum Bond

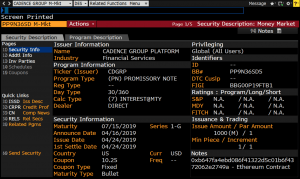

Already, Ethereum-based technology is making inroads into the legacy financial system. In September, Santander launched the first end-to-end bond on the Ethereum blockchain, while the national stock exchange of the Seychelles launched tokenized securities based on Ethereum in August.

Meanwhile, alternative investment companies such as Cadence have begun using the Ethereum mainnet in integration with the Bloomberg Terminal to tokenize securities.

As Graeme Moore explains, it’s likely that such applications of Ethereum will increase in number over the coming months and years, thereby helping accelerate the global economy.

“Money, and the creation of financial instruments that were previously impossible are what I see as the two most exciting use cases of blockchain technology in general,” he says.

“The ‘tokenization of everything’ will, in the next 5-10 years, prove to be the largest use case in dollars terms (and bitcoin (BTC) terms) enabled by blockchains.”

Mariano Conti is largely in agreement with this forecast, predicting that Ethereum could become the go-to choice for most entities wanting to record assets on a blockchain.

“As more real-world assets are represented on the blockchain, Ethereum will be the settlement layer for most of them,” he says. “It has a massive head start both in the developer ecosystem as well as operability within different protocols.”

Drivers of adoption

Of course, it’s unlikely that Ethereum-based financial platforms and products will do much to help the global economy in the immediate and short-term. Still, Graeme Moore predicts that a number of Ethereum-based applications could be developed during the coronavirus crisis, and could then go on to gain wider adoption later.

“We’re seeing numbers steadily increase in the usage of DeFi applications, but I don’t think a coronavirus-induced recession will have a noticeable direct impact on usage,” he says.

He suggests that the coronavirus could have some modest impact on usage. However, in the end, “better user experience and the typical adoption cycle of new technologies where people (and machines) realize there are things you can do with this new technology that you couldn’t do before – those are the more important drivers.”