Exclusive: Securitize CEO on When STO Explosion Will Happen

The security token offering (STO) market will certainly grow this year, but at a steady rate – and the explosion will come some time until 2021, estimates Carlos Domingo, founder and CEO of security token platform Securitize. He also believes that STOs have the potential to become a trillion dollar market, as soon as investors realize that digitizing securities is the simpler way to do it.

Securitize is a compliance platform for the primary issuance and lifecycle management of digitized securities on the blockchain. Founded in January 2018 in San Francisco, their Digital Securities (DS) protocol claims to have the highest adoption rate in the market and currently powers companies such as Blockchain Capital, 22x, SPiCE VC, Augmate, Aspencoin, Lottery, and Science Blockchain.

The company, which has Blockchain Capital, Coinbase Ventures and other entities among its investors, is planning its own digital security offering (DSO, or a different name for STO) for the second half of this year, but neither the date nor the amount they’re looking to raise is fixed yet. Also, recently, Securitize has been selected to join the IBM Blockchain Accelerator program as it works to modernize a portion of the USD 82 trillion corporate debt market using blockchain technology.

Securitize does not act as an exchange and does not plan to begin doing so. “We’re actually the compliance layer,” Domingo explained to Cryptonews.com. He further explains that they work on everything clients need to onboard investors, like know your customer (KYC), anti-money laundering (AML), accreditations. Their protocol then controls compliance and lifecycle management of the security once it’s launched on the blockchain. He adds, “We also know at all times who holds the security, but we’re no broker-dealer.”

Cryptonews.com talked to Carlos Domingo about the results Securitize has had so far, their plans for the future, and what challenges the digital securities market faces.

In November, you estimated that the digital securities market could be worth more than USD 7 trillion annually. When could this happen? What about this year?

If you think about the value of all the securities out there and everything, it’s in the trillions of dollars. The private placement market is also in the trillions of dollars. If you look at all the types of securities that could be tokenized it’s not just in the single digit trillions. The potential target market, if everything gets tokenized, is obviously super huge, but we’re still in the very early days – I don’t think we have even 1% of the assets that are going to go through this process.

But I think it’s all starting already. We’ve already issued tokens last year and signed on many other customers. In 2019, we will continue seeing the market grow, but I think the real explosion will come later. We’ll see a lot of consolidation and infrastructure building, more acceptance of this asset class by investors, so things will start growing much more rapidly as we approach 2021.

What do you consider the main challenges in the security tokens market today?

The main challenge is that the infrastructure is very basic. It’s not very sophisticated in terms of the types of securities being used, the governance is still not properly implemented, there are not many custodians. The second problem is liquidity. There’s a big promise of liquidity in this space, but the exchanges have just started launching at the end of last year, so it’s still very limited. I’m still positive about it because there are so many projects out there trying to build on security tokens, but it is yet to be done. Third is the awareness from the investor side, both investing in projects and understanding that this has nothing to do with ICOs [Initial coin offerings.]

Besides the DSO, what are your strategic goals for this year?

We are in a position, market-wise, where the press and community talk about the securities and security tokens, but the actual reality in the market is far from that talk. One goal is to try and educate, not just people coming from a crypto and blockchain background, but also people coming from the institutional side, about the advantages of digitized securities. We want them to understand that this is simply a better way to issue securities. That will really change market dynamics.

Why did you decide to use the DSO term instead of STO

We changed the terms because the terminology for security token offering reminds people of initial coin offerings (ICOs,) and that space had a lot of problems with scams. We think that a security token, as a name, would make people think of ICOs, when it actually has nothing to do with it, so it could scare institutional investors away.

At the end of the day, that’s what it is – instead of giving a paper certificate, or writing the rules about the security’s restrictions on paper and handling it manually, you basically automate all of this, you digitize the process. And you happen to use blockchain as a platform because it’s a good way to do it, but that has nothing to do with crypto or with utility tokens or anything similar.

_____________

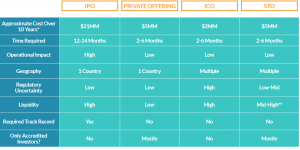

Fundraising methods

(equity case study):

_____________

How many new projects do you have in the pipeline?

We have a lot. We issued six tokens out of more than 20 customers. In the next quarter, we should have at least another six tokens that will launch, and surely more than 10 new projects in the future. Especially towards the end of last year, we signed on a lot of new customers, so we have good expectations of the coming time.

Can you tell us more about the most recent upgrade of the Aspencoin token in layman’s terms?

It’s very simple. The investors of the St Regis Aspen Resort are going to get a token in a wallet, issued on the blockchain, and this token is the representation of their percentage of ownership in the hotel. This token – a representation of a security – is what they will use as proof of ownership and what will be used by Aspen to send them all the dividends for the payouts of the hotel, directly to the token holder. If they want to exit the position later, they can trade the token on exchanges.

All real estate is an income generating asset – maybe you just do it for a year to receive some of that money back. Then, at some point in time, you can return that investment, and then you sell your token. This will also enable Aspen to have that sort of liquidity which is impossible in the international security space.

Are there any cases where you would advise against digitizing securities?

Yes, of course. In one particular case, we will not take a customer that is a very early stage company. The advantages of security tokens are not going to apply to this company. The need for automation of all the capital management is very small, there are not many investors, and that company is not going to do great in the secondary market. Even if we digitize those securities with blockchain, it does not mean that the token will have liquidity. I would not advise early stage companies to do this yet. It’s best to wait until they’re more mature to basically just walk through the process.

How many marketplaces or exchanges support the DS protocol now?

The one that we have done is now live, it’s OpenFinance. We’ve also announced partnerships for others to integrate our protocol with around a dozen of those exchanges, but the systems haven’t launched yet, so the tokens are not traded. Only three of those exchanges have done anything in the space so far, and the one that is fully live is OpenFinance and currently only trading tokens that support our protocol. They haven’t integrated any other protocol.

How strongly do you consider the STO market correlates with the general cryptocurrency market?

Theoretically, those two markets are supposed to be completely uncorrelated, because they’re two different markets. The STO market should be correlated to the underlying asset, and as you’re tokenizing real estate, and that market is booming, so the STO market should be doing very well. The problem is, many investors come into the market thinking that these are ICOs. Also, most of the security tokens are still done by a lot of blockchain companies as opposed to other types of businesses. This is where the correlation is coming from – but theoretically, it shouldn’t exist at all.

Who would you say are your main competitors?

There are not many companies out there doing exactly what we do. The two companies that are always sort of positioned against us are Harbor and Polymath, but I think they’re taking a very different approach compared to us. Harbor has just launched their platform a month ago, and as far as I know, they only have one offering on real estate. Polymath is not an end-to-end platform for managing investors, from onboarding an insurance to the life cycle. It’s basically just the protocol. They have very good branding in the industry and they were the early people there alongside with us, but I don’t think we’re really competing.

Before becoming the CEO of Securitize, you co-founded and launched SPiCE VC, a fully tokenized venture capital fund. How is it doing now? What are the results of SPiCE VC trading on the OpenFinance platform?

They’re doing quite well, trading at USD 1.36 compared to the beginning price of USD 1, which is quite a big growth for a fund that’s been one year in operation and trading on OpenFinance. This means they’re seeing some liquidity, there have been six investments already, so it’s definitely doing well.

__________

How does the process of digitizing securities work?

Carlos Domingo explains:

Fundraising is done before we start working on the project. We basically need to obtain all the information about the investors so we can onboard them on our platform and integrate that information, as well as the combined rules that we write as smart contracts that represent both the current set of investors and the restrictions your token will have. People then get an email with access to our platform where they can retrieve their tokens and keep them in their own wallet. This part doesn’t usually take long – the parts before that, deciding what the security will be, sorting out the legal stuff, that takes longer. Once we come into the picture, it’s usually not a long process – a couple of weeks to a month.

It’s also not an expensive process. So far, price hasn’t been an issue for us at all. If someone raises USD 80 million and needs to have a central depository, cease to manage their compliance or pay fees for listing to get liquidity, they will end up spending more money than what they would spend with us for sure.