DeFi Punches Above Its Weight As it Targets Bitcoin’s Thunder

As BTC volatility dropped, crypto investors are looking to altcoins and DeFi projects for yield. Some believe what is good for DeFi is good for BTC. DeFi and Bitcoin can coexist peacefully, with neither ‘eating into’ the market of the other.

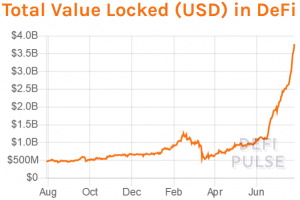

Decentralized finance (DeFi) is seemingly stealing Bitcoin (BTC)’s thunder. Aside from some minor movements, BTC has been noticeably un-volatile in recent weeks, while the total value locked into DeFi platforms has risen from USD 1bn at the beginning of June to over USD 3.77bn today.

Some industry observers regard this development as bad for bitcoin, suggesting that DeFi is driving speculative interest away from BTC and causing its price to flatline. Others suggest that DeFi will help drive additional interest towards BTC, and that both areas of the crypto industry will mutually support the other.

But regardless of whether DeFi is taking away some liquidity from the BTC market at the moment, most commentators affirm that the most popular cryptocurrency will remain the bigger element of the crypto sector over the longer term. Moreover, it seems that the recent DeFi frenzy has failed to bring crowds of new users into the Cryptoverse, while DeFi tokens skyrocketed on speculations, not results.

Rising DeFi, declining bitcoin volatility

“Given the lack of price movement and volatility in bitcoin currently, it is possible that experienced crypto investors are looking to altcoins and DeFi projects for yield instead,” said Simon Peters, market analyst at eToro.

Peters also told Cryptonews.com that proof-of-stake altcoins such as tezos (XTZ) and cardano (ADA) have performed well in recent weeks.

“On the DeFi side, lending platforms such as Compound, Maker, and Aave, where users can earn interest on deposits and borrow assets, have seen an increase in the value locked in, in recent months.”

He’s certainly correct that DeFi is doing well at the moment, as the total value locked increased over 270% in less than two months.

At the same time, Bitcoin volatility has hit a 20-month low, reaching its lowest level since November 2018.

Peters agreed that this is no coincidence, even if other factors may also be in play.

“If we did see bitcoin volatility return for a period of time, then we could see some of this value wrapped up in DeFi projects flow back to BTC, as savvy investors look to take advantage of price movements.”

Other analysts aren’t so sure. Wayne Chen – the CEO and co-founder of Canadian fintech and blockchain firm Interlapse – told Cryptonews.com that the BTC market has always fluctuated between volatility and relative stability.

“Bitcoin markets have always been sporadic,” he said. “This isn’t anything new since bitcoin had historic periods where prices were trading sideways for an extended period.”

Chen added that DeFi’s accelerated growth isn’t diverting significant money streams away from bitcoin markets. “If anything, DeFi should draw more attention to virtual currencies, blockchain, and particularly bitcoin. I consider bitcoin to be part of the DeFi movement.”

ADVFN CEO Clem Chambers also said BTC is mostly going through a phase, and that DeFi is good for it overall.

“It is said ‘what is good for jeans is good for Levis’,” he told Cryptonews.com. “This is the case with Defi and BTC. The mainstream is still a decade away from cryptocurrency acceptance so any sizzle in crypto is great for BTC.”

Not ready for prime time (yet)

Looking at the longer-term picture, opinions are also mixed as to whether DeFi or BTC will be the biggest thing in crypto.

Simon Peters is bullish on DeFi. He said, “DeFi as a movement overall has tremendous potential to bring ‘value’ to individuals in the long term for many reasons as it promotes a financial system that is open and not reliant on central authorities.”

Peters added that DeFi also has the potential to make financial processes and applications more efficient and transparent.

As such, he suggested that “DeFi is still in its infancy, but it has long term potential and, for all the reasons above, I believe the majority of the crypto market [capitalization] will be in DeFi tokens in the future.”

Wayne Chen also suggested that DeFi, which is often based around lending and borrowing, may be more intuitively understandable for much of the lay public.

“DeFi is the stepping stone for evolving the traditional finance system,” he said. “An average person will surely be more comfortable understanding general DeFi concepts than Bitcoin and blockchain.”

Others think DeFi still has a very long way to go before it can become more dominant than BTC. They may have a point, since even with USD 3.51 billion locked in, this is still only 2% of bitcoin’s current capitalization. Moreover, the total market capitalization of the top 100 Defi tokens stands at USD 7.6bn today, according to Defi Market Cap.

“DeFi is still totally niche,” said Clem Chambers. “It is the new, new big thing, but it is nowhere nearly ready for prime time.”

Google searches

Decentralized money

The cryptocurrency sector is not necessarily a zero-sum game. It’s perfectly possible that DeFi and Bitcoin can coexist peacefully, with neither ‘eating into’ the market of the other.

“Growth in DeFi is also great for BTC,” said Simon Peters. “There are various projects such as Wrapped Bitcon (WBTC), which aims to bring bitcoin liquidity to the DeFi space.”

Still, some believe that Bitcoin is the killer app for crypto, rather than DeFi.

“DeFi is just the new buzzword as ‘blockchain’, ‘ICOs’, ‘DAOs’ and prediction markets have ceased to deliver on their promises,” said Jerry Chan, CEO of blockchain service provider TAAL.

Likewise, Wayne Chen suggested that the widespread adoption of BTC would be more revolutionary than the adoption of DeFi. “Ultimately, the breakthrough is a full transition to a decentralized virtual currency such as BTC.”

___

Learn more:

DeFi on ‘Tesla’s Path’ as Tokens Skyrocket On Hopes, Not Results

Yield Farming ‘Frenzy’ Didn’t Boost DeFi User Numbers

DeFi Faces Multiple Challenges On Its Way To Dominate Crypto