Attempts to Increase Bitcoin’s Supply Would End Up With Another “Bitcoin”

A raised or unlimited supply cap would almost certainly depart from Bitcoin’s philosophy. “There would be a revolt at the miner and exchange level.”

Bitcoin‘s supply cap is one of its biggest selling points. Limiting the network to almost 21 million BTC, the cap makes Bitcoin a ‘deflationary’ currency.

Naturally, people have been questioning whether it might be possible to remove this cap. In theory, by simply submitting a pull request to Bitcoin Core’s GitHub, a hosting service that is most often used for code, repository, a developer could potentially have the cap’s removal introduced into a future version of Bitcoin.

But according to Bitcoin developers and other industry players, the likelihood of this happening is very low. Yes, it’s technically feasible, but at least now there’s an enormous social consensus against such removal. Even if such a pull request goes through, most likely it would end up with another version of “Bitcoin” while the original cryptocurrency would still have its supply cap.

Bitcoin’s philosophy

The most recent debate kicked off with a tweet from Angela Walch, a research fellow at the UCL Centre for Blockchain Technologies.

As Walch points out, there are only so many reasons why a pull request to update Bitcoin Core’s code can be rejected by an editor. These include duplication of effort, disregard for formatting rules, being too unfocused or too broad, being technically unsound, not providing proper motivation or addressing backward compatibility.

However, another cause for rejection is the failure to comply with Bitcoin’s philosophy. It’s here that Walch’s suggestion falls down, since a raised or unlimited supply cap would almost certainly depart from this philosophy, and it would almost certainly confront widespread opposition from Bitcoin developers.

“In order for a pull request to be accepted, it first needs to go through peer review,” explains Benedict Chan, the chief technical officer for BitGo.

“A change to the supply cap would represent a significant modification to the behavior of the software properties, and would likely generate substantial discussion and pushback “NACK”s [negative-acknowledgments]. Without clear consensus, no Bitcoin core maintainer would merge it into the code repository.”

But even if Bitcoin developers were to insert the removal of the cap into a new Bitcoin Core version, this doesn’t necessarily mean that Bitcoin would have its cap removed.

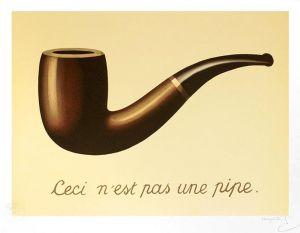

Ceci n’est pas Bitcoin

“Once the new release is distributed, different stakeholders – users, miners, and various organizations that service the industry (exchanges and wallet providers) must all download and run it,” says Benedict Chan.

“These stakeholders are incentivized to verify the behavior of the code, understand what they are running, and (hopefully) act in a manner that will be positive for themselves and Bitcoin. They may not see the removal of the supply cap as an improvement, and thus not move forward to run it.”

In other words, even if the developers release a new version of Bitcoin without the supply cap, the people who actually run Bitcoin may refuse to use it.

Guardian Circle CEO/Co-founder Mark Jeffrey agrees.

“If a change of this magnitude WERE to somehow make it through the Bitcoin developer community, there would be a revolt at the miner and exchange level,” he says. “I’d expect a major fork to occur, and I would expect the market to largely rally around the fork where the 21m cap was preserved.”

A fork into two separate cryptocurrencies would occur, and this leads CEO and co-founder of Bull Bitcoin, Francis Pouliot, to argue that the forked cryptocurrency without the 21 million supply cap would no longer be Bitcoin.

He tells Cryptonews.com, “Bitcoin’s supply cap cannot be lifted, because whatever shitcoin is airdropped to existing Bitcoin users, even if its promoters call it Bitcoin, will be incompatible with the existing Bitcoin network and therefore would not be Bitcoin.”

The security question

Meanwhile, there is another Bitcoin supply cap-related narrative, popular among the Bitcoin skeptics and in the camp of altcoins and “altchains.”

For example, Emin Gün Sirer, CEO of AVA Labs, the developer of the AVA blockchain, says that an alteration to the 21 million cap might be necessary after three more Bitcoin mining reward halvings due to security reasons.

“As the amount of awards given to the miners dwindles down, the security of the network will drop,” he says, forecasting “massive double-spend attacks targeting exchanges” and suggesting that removing the supply cap would solve this.

However, Bitcoiners say that Sirer is wrong and halving block rewards won’t weaken Bitcoin’s security. Read about it here.